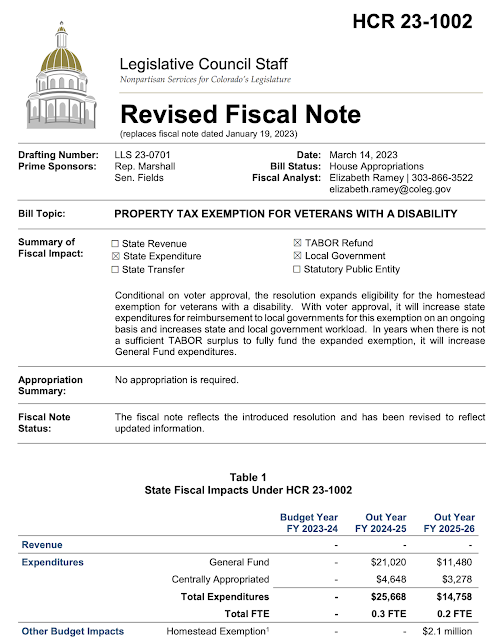

Colorado LSC initial $4.5 million estimate for HCR23-1002 (TDIU) was inaccurate

(see revised budget impact from LSC correction below, based on this analysis)

(see revised budget impact from LSC correction below, based on this analysis)

The Cost for HCR23-1003 Total Disability for Individual Unemployability (TDIU) Property Tax Exemption

1. TDIU is regulatory, not statutory. The key section of the US regulation reads:

“Total disability ratings for compensation may be assigned, where the schedular rating is less than total, when the disabled person is, in the judgment of the rating agency, unable to secure or follow a substantially gainful occupation as a result of service-connected disabilities. Provided that, if there is only one such disability, this disability shall be ratable at 60% or more, and that, if there are two or more disabilities, there shall be at least one disability ratable at 40% or more, and sufficient additional disability to bring the combined rating to 70% or more.” (38 CFR § 4.16a.)

2. TDIU benefits granted under the VA Rating Schedule are intended to compensate veterans for the average impairment in earning capacity that results from service-connected disease or injury. TDIU is a special additional benefit to address the truly unique disability picture of a veteran who is unemployable solely from service-connected disability, but for whom the application of the Rating Schedule does not fully reflect the veteran’s level of impairment. TDIU allows the veteran to receive compensation at a rate equivalent to that of a 100% schedular award.

3. VA pays basic compensation benefits to veterans incurring disabilities from injuries or diseases that were incurred or aggravated while on active military duty. VA rates the severity of all service-connected disabilities by using its Schedule for Rating Disabilities. The schedule lists a multitude of disabilities and assigns each disability a percentage rating, which is intended to represent an average earning impairment the veteran would experience in civilian occupations because of the disability. Veterans awarded service-connected disabilities are assigned single or combined (in case of multiple disabilities) ratings ranging from 0 to 100%, in increments of 10%, based on the rating schedule; this is known as a schedular rating. Diseases and injuries incurred or aggravated while on active duty are called service-connected disabilities. To avoid an unfair “one size fits all” disability evaluation, disability compensation can be increased to the full 100% level if VA determines that the veteran is factually unemployable (not able to engage in substantially gainful employment) based only on the service-connected disability exceeding in severity anticipated in the rating schedules. VA can assign a total disability rating of 100% to veterans who cannot perform substantial gainful employment because of service-connected disabilities, even though their schedular rating is significant but less than 100%...but is in fact totally disabling.

The initial cost estimate by LSC of $4.5 million if approved by the public is inaccurate. Several facts need to be considered that should reduce this significantly:

1. Most importantly, the GAO reports that 54% of TDIU veterans are age 65 or older, and thus already eligible for the senior property tax exemption if in their home ten years or more. Those TDIU veterans present no additional burden for the property tax exemption program. An unknown number of TDIU veterans under age 65 have partners over age 65 and thus otherwise eligible for the exemption.

2. 2847 Colorado TDIU veterans who are permanently and totally disabled from line-of-duty injuries are barred from the exemption. Colorado has 13589 VA 100% permanently and totally disabled veterans, 76% of whom are homeowners No VA data seems available to determine how many of these are “P&T (permanent and total)” to qualify for the current property tax exemption. VA reports the ratio of TDIU/100% veterans is about 45/100, and 46% of TDIU veterans are age 65 or younger. Thus, Colorado is ignoring the needs of 20% of our totally disabled homeowning vets under age 65. The exemption for TDIU veterans would be under $2 million annually.

3. Colorado seems unique among the states in distinguishing between VA 100% schedular and TDIU. Military.com rates Colorado, prizing ourself as “Veteran Friendly,” only as a mediocre 27th among the states offering veterans’ benefits.

4. 60%+ of TDIU veterans are in the World War II-Vietnam era. The age group 50-65 represents 28% of all TDIU recipients. Their participation in a property tax exemption program is just for a few years before aging into the senior exemption...they “age out” of any potential TDIU burden on the state.

According to the National Center for Veterans Analysis and Statistics, the total veteran

population is set to decline from 20.8 million in 2015 to 12.0 million by 2045; total annual change is -1.8

5. 27.2% of Colorado’s veteran households have an “extraordinarily high” burden of total income for housing. 6.9% of veterans live below the poverty line, although totally disabled veterans’ disability benefits are above that level unless family size is considered.

6. 35% of TDIU beneficiaries have mental health conditions as their major diagnosis (of which more than two-thirds are posttraumatic stress disorder [PTSD] diagnoses), followed by musculoskeletal conditions (29%), and cardiovascular conditions (13%.)

7. Of all Colorado veterans receiving disability compensation, 6% are rated as 100% permanently and totally disabled. 4.5% of Colorado’s total veteran population have a disability rating of TDIU.

8. It is misleading to refer to this category of veterans as “individually

unemployed" without further explanation. Rather, they are totally disabled veterans who, solely because of their military injuries or illnesses, have been carefully assessed by VA physicians, claims officials and vocational specialists as being totally and permanently disabled, unable to work above any marginal employment. The term “total disability for individual unemployability” should be used throughout, rather than “unemployed!” TDIU veterans aren’t unemployed; they have left active duty service physically unable to work, whereas VA-rated 100% disabled veterans are often able to continue useful employment, trained for other opportunities, other careers, and are encouraged to find work for obvious financial and mental health reasons. “Extraneous” factors, such as nonservice-connected disabilities, injuries occurring after military service, availability of work, or voluntary withdrawal from the market are not considered as factors for TDIU ratings.

Where the rating schedule is found to be inadequate to fairly compensate a veteran for the inability to be gainfully employed, Veteran Benefit Administration (the administrative portion of VA) may refer cases consideration of a TDIU rating on an “extrascheduler” basis

9. The US Department of Veterans Affairs has just two categories of veterans assessed to be totally and permanently disabled due to their injuries or illnesses. There are no differences in their federal benefits or compensation.

a. VA “100% permanent and total schedular.” is a rating schedule which assigns a degree of total disability using a formula set by law ( 38 CFR 3.340, 38 CFR 3.341(a), and 38 CFR 4.16) for a full range of illnesses and/or injuries suffered by veterans while on active duty (or, for Reserve Components, while on active training status for when called to federal service.)b. The second is TDIU, a unique program created in 1933 to “fill the gap” in situations where a veteran’s line-of-duty illnesses or injuries are far more serious and exceed the schedular provisions, or when the combination of the veteran’s active duty illness or injuries are at least 70% but when considered with with other, lesser military injuries or illness have made the veteran totally disabled. This involves separate medical and administrative assessments: one evaluating military-related disabilities and a second to consider whether those military disabilities alone make employment impossible. This leaves the TDIU veteran at a fixed disability compensation at the 100% level, never able to continue productive employment.

TDIU criteria for unemployability are quite similar to those used by the Social Security Administration to determine total disability, except TDIU is far more restrictive, being based solely on military line-of-duty injuries or illnesses. SSDI considers the broader picture, including all military and civilian issues to determine total disability. A veteran can be SSDI-eligible for overall disability yet unqualified for TDIU unless military disabilities make anything above-marginal employment impossible. Note that many veterans having between 10%-90% VA disability (neither 100% nor TDIU) but are qualified to receive SSDI. Between SSDI, VA 100% disability and TDIU, TDIU is the most serious and restrictive disability scheme.

Like SSDI, a TDIU veteran is monitored for their continuing total disability. Earned income, whether employed or self-employed, other than sheltered workshop or below-poverty level income is disqualifying. Such a situation would result in termination of federal TDIU and any related state benefits. This limit applies only to the veteran's earnings, and not to the veteran's unearned income or household income. Managing TDIU benefits involves not only assessing initial eligibility for benefits, but also ensuring beneficiaries’ ongoing eligibility by identifying those who are not in compliance with the earnings limit.

VA rating specialists initiate TDIU evaluations when a veteran or their VA physician submits an application for TDIU benefits or his or her application for compensation benefits contains clear evidence of unemployability. In all cases, before granting benefits, rating specialists must evaluate the impact that the veteran’s service-connected disability(ies) have on his or her ability to perform gainful employment, which for decision-making purposes is generally interpreted as employment that is more than “marginal employment.”

Marginal employment for a TDIU veteran may also be held to exist, on a case-by-case basis, for a veteran maintaining employment at a sheltered workshop or family business with annual earnings at or below the poverty threshold.

VA rating specialists are to rely on various sources of information for the evidence needed to support such a determination, including an employment and earnings history furnished by the claimant, basic employment information from the claimant’s employers (if any), and a medical exam report from Veterans Health Administration (the medical side of VA.) If the claimant had received vocational rehabilitation assistance from VA or disability benefits from SSA, the rating specialist might also seek information on these services or benefit decisions. Many veterans seeking TDIU benefits seek a vocational evaluation, offered by many states’ employment agencies to assess any remaining employability.

Quality of life reduction, a serious issue and often a factor in other disability compensation programs, is not assessed in VA issues. About 30% of totally disabled veterans receive assistance from family members with activities of daily life impairments, thus greatly reducing household income.

Wes Carter, Chair

The C-123 Veterans Association