On Wednesday the United Veterans of Colorado met with legislators who sponsored last years' constitutional amendment adding Gold Star Spouses to the property tax exemption. We're grateful for their outstanding leadership, especially from Representative Cathy Kipp!

Colorado recognizes sacrifices of our totally disabled veterans, awarding a partial property tax exemption to 100 percent totally and permanently disabled veterans. The U.S. Department of Veterans Affairs has two types of 100% disabled veterans – (1) vets with a 100% disability (2) vets with a total disability rated “Total Disability for Individual Unemployability” (TDIU.) VA benefits for the two types are identical, but Colorado’s TDIU veterans are unfairly denied the exemption

Friday, March 31, 2023

Monday, March 20, 2023

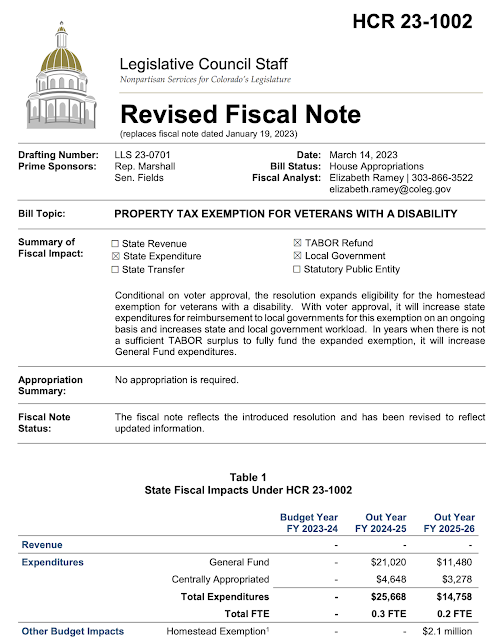

Colorado LSC initial cost estimate of $4.5 million for HB 23-1002 (TDIU) was inaccurate

(see revised budget impact from LSC correction below, based on this analysis)

a. VA “100% permanent and total schedular.” is a rating schedule which assigns a degree of total disability using a formula set by law ( 38 CFR 3.340, 38 CFR 3.341(a), and 38 CFR 4.16) for a full range of illnesses and/or injuries suffered by veterans while on active duty (or, for Reserve Components, while on active training status for when called to federal service.)b. The second is TDIU, a unique program created in 1933 to “fill the gap” in situations where a veteran’s line-of-duty illnesses or injuries are far more serious and exceed the schedular provisions, or when the combination of the veteran’s active duty illness or injuries are at least 70% but when considered with with other, lesser military injuries or illness have made the veteran totally disabled. This involves separate medical and administrative assessments: one evaluating military-related disabilities and a second to consider whether those military disabilities alone make employment impossible. This leaves the TDIU veteran at a fixed disability compensation at the 100% level, never able to continue productive employment.

Thursday, November 10, 2022

VICTORY FOR GOLD STAR SPOUSES!

In a sweeping victory for the United Veterans of Colorado and Gold Star Spouses, voters approved amending the Colorado Constitution Article X Section 3.5 to extend the partial property tax exemption to Gold Star Spouses.

Several years of efforts, of resolutions passed by the American Legion, leadership of the UVC and patience of the Gold Star spouses themselves, all finally came to the best possible resolution – not only passed as required with 55% of the voters approving, but by an overwhelming 88%.

Tuesday, April 12, 2022

TDIU = actual VA TOTAL disability rating

A previous director of the Colorado Division of Military and Veterans Affairs wrote me six years ago to state that one reason Colorado denies TDIU veterans the state partial property tax exemption is that the state law requires a VA TOTAL DISABILITY RATING, and he explained that TDIU is somehow "only" compensation at the 100% rate and not an actual disability rating.

CDMVA hasn't made any visible effort to care for TDIU veterans the same as it cares for 100% schedular. A variety of reasons have been tossed out but as for TDIU being an actual disability,VA disagrees with CDMVA.

From Title 38, Chapter 4 (§ 4.15 Total disability ratings)

"It is the established policy of the Department of Veterans Affairs that all veterans who are unable to secure and follow a substantially gainful occupation by reason of service-connected disabilities shall be rated totally disabled"

Saturday, September 4, 2021

YouTube Video added to explain TDIU & Colorado's Disabled Vet Property Tax Exemption

Here's a PowerPoint briefing on Colorado's TDIU veterans ("total disability for individual unemployability.") Our effort is to qualify these 4800 totally disabled veterans for the same disabled veteran property tax exemption offered other Colorado veterans with a VA 100% rating.

TDIU and 100% are the only two ways VA categorizes a vet as totally and permanently disabled, but Colorado does not permit TDIU vets the small property tax exemption.

Friday, August 20, 2021

COLORADO LEGISLATURE & GOVERNMENT: "TDIU VETS ARE ON THEIR OWN"

Colorado voters approved Referendum E in 2006, not knowing that the legislature had already defined "qualified veteran" so as to exclude vets with the VA "total disability for individual unemployability," (TDIU.)

Colorado's legislators and government officials chose to interpret the requirement for the "VA 100% rating" so as to exclude totally and permanently disabled veterans who are compensated at the 100% level...because they are in fact totally and permanently disabled. The only difference being,

TDIU veterans have a totally disabling injury, worse than standard VA tables are meant to recognize, that is in fact totally and permanently disabling. These are the same totally and permanently disabled veterans – one honored by Colorado with a small property tax exemption and the other totally ignored. Are they less somehow than worthy in the eyes of our mostly non-veteran legislators?

Actually, to be completely correct, TDIU vets haven't been truly ignored. That's because the only attention given TDIU veterans byColorado's legislature and government has been opposition to extending to these vets, totally and permanently disabled in the line of duty, the small property tax exemption.

That's the extent of their efforts. Less than zero, because it was years of "absolutely not" instead of "let's find a way." That has meant years of being denied the specific constitutional benefit voters were told we approved as Article X Section 3.5 for all of Colorado's veterans with honorable service who became permanently and totally disabled in the line of duty.

Have we abandoned thousands of Colorado's TDIU veterans?

Saturday, July 3, 2021

State Homestead Exemptions - Seventeen states offer 100% disabled Vets a 100% property tax exemption

State Homestead Exemptions – These states are leaders in being especially "veteran friendly." They offer 100% disabled veterans a total personal property tax exemption. In most cases, the exemption carries on to the survivor as well.

By contract, Colorado permits a meager exemption of just half of the first $100,000 in assessed value, saving the veteran about $600.

While insisting Colorado is "veteran-friendly," we then deny the small exemption to Gold Star Widows and to nearly 40% of the state's totally disabled military retirees (TDIU, separated from their service for career-ending line-of-duty injuries.

- #1. ALABAMA

- #2. ARKANSAS

- #3. FLORIDA

- #4. HAWAII

- #5. ILLINOIS

- #6. IOWA

- #7. MARYLAND

- #8. MICHIGAN

- #9. NEBRASKA

- #10. NEW HAMPSHIRE

- #11. NEW JERSEY

- #12. NEW MEXICO

- #13. OKLAHOMA

- #14. PENNSYLVANIA

- #15. SOUTH CAROLINA

- #16. TEXAS

- #17. VIRGINIA

Wednesday, June 30, 2021

VA Benefits for a “Traditional Reservist?”

Traditional reservists aren’t eligible for most VA benefits because “active duty for training” doesn’t count towards true veteran status – even if it is a year or more such as Undergraduate Pilot Training. Regardless of how long one’s initial active duty for basic and technical school might be, the law doesn’t recognize that as “active service.”

VA recognizes completion of an active-duty enlistment, or active duty during wartime to qualify a servicemember for benefits, but UTAs, annual tour, active duty for basic and other training are grouped into ineligible “active duty for training.” No bennies.

BUT – there’s a big exception to that if you experience a disabling injury or disease. Tinnitus is just one such injury. That ringing in the ears, or wind noise or low hum is caused by loud noises. Noises like a C-123 or C-130 makes. Noises like an M-16 makes at 154dB.

Flyers, tank crews, infantry, artillery and others around loud noises in a military setting often suffer tinnitus, and VA recognizes that as a frequent disability - in fact, it is the most common disability veterans have.

If you have tinnitus or hearing loss you might be entitled to VA care and compensation for that disability, and if you are, that makes you a veteran with all the benefits that wartime veterans receive. Benefits that you’ve earned from damage done your ears.

I looked into this in December 2020 to help a man who was an army reservist with tinnitus from his basic training back in 1968. He fired the M-14 rifle and did not have any ear protection. Noises of 85 dB and above can cause permanent hearing loss and tinnitus, and our aircraft are far noisier than that: The C-130 cockpit is steady at over 112 dB. The noise is even worse in the aircraft rear!

After my altitude chamber ride at Edwards AFB I started flying C-130 transports in 1974. I recall that by 1976 or so we received the 3M yellow foam earplugs. They only provided some protection from noise hazards but it was all we had plus our crew headsets; even together they were of little help.

There was still significant noise reaching the inner ear to cause damage. This kind of damage is permanent and cumulative and can evidence itself in worsening tinnitus and/or hearing loss even years later.

Here is my point in the VA’s own words:

“When a claim for service connection is based on a period of active duty for training, there must be evidence that the individual concerned became disabled as a result of a disease or injury incurred or aggravated in the line of duty during the period of active duty for training.”

That is per 38 U.S.C. § 1131 (see also 38 U.S.C. § 1110; 38 C.F.R. § 3.303(a). See CAVC Hensley v. Brown –

“claimant may establish direct service connection for a hearing disability initially manifest several years after separation from service on the basis of evidence showing that the current hearing loss is causally related to injury or disease suffered in service.”( 5 Vet. App. 155, 164 (1993).” Also see VA Training Letter 10-02 at 15 (rescinded re: incorporation into VBA Adjudication Procedures Manual (M21-1), pt. III, subpt. iv, ch. 4, § D.1-3)

VA compensation for a 10% tinnitus disability is a modest $144 per month. For someone who served in the reserve components the real importance here isn't the money but rather a hearing injury establishes legal veteran status with all the benefits that attach to being a wartime veteran (we’ve been in a period of war ever since Desert Storm.)

Sometimes there are secondary issues to adding to hearing loss like depression or hypertension. There can even be tertiary issues, something like hearing loss causing depression which is known to cause heart issues. Rarely, there have been vets getting up to 50% disability ( benefits plus $995/month) based on hearing loss and complications.

You might not need them now, but benefits can include elderly/low-income pension rights, medical and pharmacy (perhaps with modest co-payments,) rehab, hearing aids, VA home loan, education, and even a new program for veterans called Veteran Directed Care.

It is for vets faced with significant loss of ADLs (activities of daily life.)

There is no disability rating required, only that a vet be enrolled in VA health care, and with it help can be offered for whatever ADL shortfalls the vet experiences.

If you believe you have tinnitus or hearing loss, or maybe some other issue that began during service and still affects you, get advice from the VA hotline, one of the veterans’ service organizations like DAV or VFW, or your city/state VA office. Get a claim entered immediately because benefits are dated from when VA gets your claim, not when they approve it months later.

Late note: the Army reservist whose claim I helped prepare got a welcome disability rating of 40% service connection (backdated to date of his application) when VA approved his claim in early June 2021; he has a couple issues still pending that could increase the award significantly. This all went back to hearing injuries during basic training and AIT over half a century ago; good thing he saved, the documentation from his sick call and hospital treatments!

I hope this helps someone!

Monday, June 28, 2021

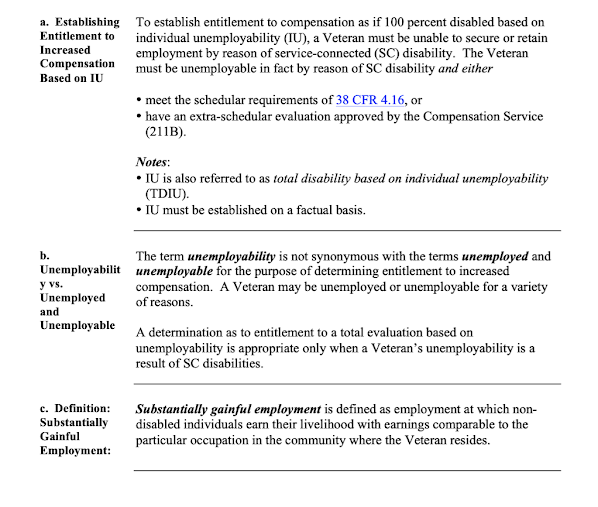

What is VA "TDIU" and how does VA use that rating?

I've needed to go into an explanation what VA TDIU is (CLICK HERE for VA's factsheet) but I overlooked doing it until questions arose at Sunday night's United Veterans Coalition banquet in Denver. A gentleman at our table was from Arapaho County and asked me about helping his Army veteran son.

A skillful veteran’s service officer (VFW, DAV, state or county) can advise about eligibility for Total Disability for Individual Unemployability (TDIU, and sometimes just IU) and help one obtain this valuable benefit if qualified. These pros know the mysterious VA bureaucracy and the evidence required to obtain favorable benefit claim decisions for disabled veterans. Their objective for every disabled vet they assist is to get the maximum entitled benefit. And actually, that's VA's goal as well.

The VA requires veterans to prove their qualifications for disability benefits but even then, VA routinely denies legitimate TDIU claims.

Qualifying for TDIU:

The VA’s Individual Unemployability (TDIU) benefit represents somewhat of a loophole for disabled veterans in the VA system. It allows assigning a total disability rating for compensation (100%) to to a vet when the vet’s actual disability exceeds the VA's rating chart. TDIU was established decades ago when VA appreciated that there were situations where the regular percentage allowed for a disability is inadequate and where the vet's particular disability (regardless of any rating chart) is in fact total. TDIU ratings account for situations where the line-of-duty disability has made employment impossible, making employment impractical.

Total Disability for Individual Unemployability is based on the vet’s proven inability to maintain “substantially gainful employment” due to a service-connected illness or injury.

VA regulations usually require the vet to have at least one service-connected disability rated at 60% or more. Or, if the vet has multiple disabilities, at least one must be ratable at 40% or more, and in combination the vet’s disabilities confer a combined rating of 70% or more.

Veterans who do not meet the minimum disability percent rating requirements for IU may be considered if they can show exceptional or unusual circumstances, such as that their disabilities directly interfere with their employability or require hospitalization often enough to make steady employment impractical. Or, that a secondary issue such as pain from an SC back injury makes competitive employment painful and unwise to attempt.

The veteran’s claim must show that service-connected disability or disabilities are “sufficient, without regard to other factors, to prevent performing the mental and/or physical tasks required to get or keep "substantially gainful employment.”

“Substantially gainful employment” is defined as “employment at which non-disabled individuals earn their livelihood with earnings comparable to the particular occupation in the community where the veteran resides.”

VA regulations also make it clear that substantially gainful employment is more than marginal employment, which is a secondary standard for evaluating a vet’s earnings. Marginal employment is defined as earning income that does not exceed the poverty threshold for one person as established by the Census Bureau. For 2021, that threshold is $13,100 for an individual under age 65.

Vets in sheltered work environments, employed by family businesses or self-employed may earn more than marginal employment income and still be considered for IU.

Money earned by participating in the Veterans Health Administration’s (VHA’s) Compensated Work Therapy (CWT) Program is not counted as income for TDIU purposes.

A vet who has a 100% disability rating according to the VA rating schedule is permitted to maintain substantially gainful employment, but an TDIU benefit recipient is not.

TDIU benefits parallel those of 100% schedular. The compensation is the same with identical special allowances for dependents, clothing, aid and attendance, travel, and special monthly compensation. A prepaid $10,000 is available upon application. Rehab, pharmacy, audiology, prosthetics, optometry, and other VA medical care is the same. There are some situations where dental care is also provided. One of the most important benefits for both TDIU and 100% schedular is CHAMP-VA for Tricare-like family medical care. Often with age and increasing difficulties with SC issues, a TDIU-vet will transition into 100% schedular.

VA TDIU Eligibility Requirements:

Evidence that must be part of a veteran’s disability benefits claim to obtain IU / TDIU benefits includes:

• Medical evidence of the veteran’s current physical and mental condition, e.g., results of VA examinations, hospital reports, and/or outpatient records. As in other claims, the VA may schedule a medical examination if the veteran’s medical evidence is incomplete or inconsistent.

• Employment and work history for five years prior to the date on which the veteran became too disabled to work, as well as for any work performed after this date.

• Forms completed by each employer for whom the veteran worked during the 12-month period prior to the date the veteran last worked.

• Social Security Administration reports if the vet receives Social Security Disability benefits, if the veteran’s other evidence is insufficient to award compensation

• Records from the VA’s Vocational Rehabilitation and Employment Service (VR&E) if evidence suggests rehab was undertaken but unsuccessful or was found to be medically unfeasible. VR&E testing can be requested by any vet enrolled in VA health care. Social Security Disability records are persuasive.

If the TDIU benefit is granted, the vet must complete a VA employment questionnaire each year until the age of 69 to affirm that he or she remains incapable of maintaining substantially gainful employment.

VA disability raters are trained to consider TDIU in exceptional cases, yet about 40% of all totally disabled vets get that rating and 60% or so are 100% schedular. Examiners can't consider the vet’s age or distinguish between retirement and inability due to age as opposed to a true service-connected disability resulting in unemployability.

As in other cases, VA claims examiners may request additional information at any time to supplement or clarify evidence in a veteran’s claim. This, of course, slows the process. Submit as much persuasion as can be gathered!

Good luck with your claim. NOW – HELP OTHER VETERANS!

Text of American Legion resolution supporting Gold Star Wives property tax exemption

WHEREAS, on April 5, 2021 the Seventy-third General Assembly of the State of Colorado issued Senate Joint Resolution 21-010, resolving on behalf of the citizens “That we, the members of the Colorado General Assembly, honor the pride and the pain of the parents and partners and children and siblings of our fallen heroes who lost his or her life serving our country and protecting our freedom; and recognize the families of these proud patriots with an expression of profound gratitude and respect” and

Thursday, June 24, 2021

Colorado Legislature Wraps Up, Gets Set for 2022

All hope for Gold Star Wives' property tax exemption rose suddenly during the last few days of the 2021 legislative session...and were shot down even faster! The House passed HB21-1002 unanimously but the Senate Veterans and Military Affairs Committee destroyed hopes for this legislation with just a few minutes conversation among the Democrats. Party line vote: Dems=NO, GOP-YES, but the measure failed with Dems in the majority.

| Oh, dear. I'm afraid we're back to the old drawing board. |

Saturday, June 19, 2021

United Veterans Committee Crafting State Legislative Agenda for 2022. TDIU Veterans Issue Proposed to the Committee

The decision will be based on input from all levels of UVC organizational members. This is an issue I've advocated about for six years. I ask everyone to get behind this agenda item, voicing your support directly to the state legislative affairs committee and the executive committee as all such potential agenda issues are being weighed this summer.

Inclusion of TDIU veterans affects about 2,000 Colorado vet homeowners and survivors, at a cost to Colorado at about $2.6M. Voters originally approved the Disabled Veteran Property Tax Exemption as Referendum E in 2006. The Blue Book described the benefit for "totally disabled veterans unable to work" due to line-of-duty injuries and illnesses. Somehow, "unemployability" was written into the enabling legislation and statue after the amendment was approved. That's not what the voters thought we were approving.

I hope the legislature to include these ignored 100% disabled veterans by exercising its authority to redefine "qualified veteran." A revised statute can include TDIU vets.

Colorado utilizes VA definitions for management of veterans benefits, so it is very telling to see VA's own rules from VAM21-1 on TDIU. Read carefully, and compare to the language of Referendum E, the enabling statute and the Disabled Veteran Property Tax Exemption form and instructions.

As for Gold Star Wives, the Legislative Support Staff calculated the cost to Colorado would be only $93,000, so it is very, very hard to understand why every Democrat voted against these 140 Gold Star Wives' much too small a benefit.United Veterans Coalition Considering Agenda Item: Property Tax Exemption for Gold Star Wives

The United Veterans Coalition state legislative affairs committee is considering addition of the Gold Star Wives Disabled Veteran Survivor Property Tax Exemption for inclusion in the 2022 legislative agenda.

The United Veterans Coalition state legislative affairs committee is considering addition of the Gold Star Wives Disabled Veteran Survivor Property Tax Exemption for inclusion in the 2022 legislative agenda.

The decision will be based on input from the Gold Star Wives and other primary organization members. I encourage everyone having an opinion on the issue to voice it through their primary group representatives.

The issue was unanimously approved by the Colorado House in the session just ended but killed by the Senate Military and Veterans Affairs Committee. The idea was to submit a referendum to the voters next term, amending the constitution's Article X Section 3.5 to include these active-duty troops' survivors. I believe the change could have been made via statute, a much easier path than changing the consitution.

The Legislative Support Staff calculated the cost to Colorado would be only $93,000, so it is very, very hard to understand why every Democrat voted against these 140 Gold Star Wives' small benefit.

Tuesday, June 15, 2021

COLORADO SENATE SNUBBED FAMILIES – KILLED GOLD STAR WIVES' PROPERTY TAX EXEMPTION

|

| June 7 2021: Colorado Senate killed Gold Star Wives bill for given survivors of totally disabled veterans (HCR21-1002 |

Monday, June 14, 2021

Colorado Voters Have a Long Memory - especially about how veterans and their survivors are treated

I believe Colorado's Democrat legislators have initiated the more important advances in veterans' benefits, but it would be wrong to conclude that either party is truly disinterested or uncaring. Democrats controlled the House and Senate in 2006 under a Republican governor and are together credited with getting Referendum E in front of the voters. There, the constitutional amendment found overwhelming support. This established the Disabled Veterans Property Tax Exemption in 2007 and reflected well on both parties.

Sunday, June 13, 2021

C-123 Veterans Association Joins Colorado's United Veterans Coalition

To better support state and federal veterans' issues, The C-123 Veterans Association has affiliated with Colorado's United Veterans Coalition (UVC.) UVC is the single most effective voice for over 350,000 veterans in Colorado. It brings together the VA and nearly every interested organization and political entity in the state.

RADM Dick Young USNR (Ret.) was elected president last week. UVC will celebrate is annual banquet on June 27 and tickets are still available.

How'd that Colorado Senate vote go for Gold Star Wives' property tax exemption?

June 7 2021: HOW DID COLORADO STATE SENATORS VOTE TO PERMIT GOLD STAR WIDOWS THE SAME PROPERTY TAX EXEMPTION COLORADO GIVES DISABLED VETS' WIDOWS? One Guess. | |||

| DEMOCRATS = 100% NO GOP = 100% YES Interesting. And very, very revealing. Every senator* who voted "YES" to honor our Gold Star Wives with SJR21-010 in May seemed to see things differently on June 7, and voted "NO" on HCR21-1002. Thumbs down on spending $93,000 to permit these 140 widows of active-duty troops same small partial property tax exemption Colorado now gives survivors of our 100% disabled veterans. Here are their empty words from SJR21-010 tossed to the wind, now shown to be useless and meaningless: "That we, the members of the Colorado General Assembly honor the pride and the pain of the parents and partners and children and siblings of our fallen heroes and recognize the families of these proud patriots with an expression of profound gratitude and respect." * voting no:

|

Wednesday, June 9, 2021

THE REST OF THE STORY: The Brief Life & Sudden Death of Colorado's Gold Star Wives' Tax Exemption

Not about to waste a perfectly good opportunity to turn virtually every veterans' wrath against them, yesterday the Colorado Senate Veterans Committee killed HCR21-1002.

Ever budget-conscious, the committee's discussion indicated they felt it terribly unwise to "waste" $94,000 permitting widows of active-duty troops the same very modest property tax break now given widows of our 100% disabled veterans. Colorado has 140 widows of active-duty troops, all denied the small exemption because the awkward wording of the 2014 legislation restricted the exemption to widows of a veteran already getting the exemption.

Get it?

a) Die on active duty = no widow's tax exemption, or

b) Die after active duty as a disabled vet = widow gets exemption.

Troops call this kind of situation "bass-ack-wards."

The rest of the story? After a unanimous House vote for HCR21-1002, it was killed because some senators might to do "something" next year to go to the voters in 2023 for some relief for the widows in 2024.

"Something" apparently being a larger overhaul of the entire property tax exemption issue that costs $150,000,000 each year. Gold Star Wives (mostly elderly of World War II, Korean Conflict and Vietnam eras) would have added 0.00062 to that $150M.

I think the House could have chosen a better approach to the Gold Star Wives, something easier than the constitutional amendment HCR21-1002 required. The legislature took it on themselves to include widows of 100% disabled vets who were receiving the exemption by HB14-1373, not an amendment which is more difficult.

All the House had to do was use 21 new words refine the definition of "qualifying veteran" to include "or a member of the Armed Forces of the United States who died in the line of duty on active service" in a new statute.

Here's what it took to include survivors in the original 2014 bill:

39-3-203. Property tax exemption - qualifications. (1.5) (a.5)

FOR PROPERTY TAX YEARS COMMENCING ON OR AFTER JANUARY 1, 2015, FIFTY PERCENT OF THE FIRST TWO HUNDRED THOUSAND DOLLARS OF ACTUAL VALUE OF RESIDENTIAL REAL PROPERTY THAT AS OF THE ASSESSMENT DATE IS OWNER-OCCUPIED AND IS USED AS THE PRIMARY RESIDENCE OF AN OWNER-OCCUPIER WHO IS THE SURVIVING SPOUSE OF A QUALIFYING DISABLED VETERAN WHO PREVIOUSLY RECEIVED AN EXEMPTION UNDER PARAGRAPH (a) OF THIS SUBSECTION (1.5) IS EXEMPT FROM TAXATION.

Here's the redefined "qualifying veteran":

SURVIVING SPOUSE OF A QUALIFYING DISABLED VETERAN WHO PREVIOUSLY RECEIVED AN EXEMPTION or a member of the Armed Forces of the United States who died in the line of duty on active service UNDER PARAGRAPH (a) OF THIS SUBSECTION (1.5) IS EXEMPT FROM TAXATION.

And that's "the rest of the story!"

Here's the Colorado Bar Association's statement:

"Gold Star Wives, survivors of active-duty servicemembers, are denied the exemption because the state constitution (Amendment X Section 3.5) allows the exemption to survivors of veterans already in receipt of the benefit. Colorado legislators apparently did not consider the issue of active-duty deaths. Loss of the servicemember on active duty precludes the 'already in receipt of the benefit' requirement. Proposed is a redefinition of a qualified recipient to include survivors of active duty servicemembers who die in the line of duty."

Tuesday, June 8, 2021

How interesting. And HOW CONFUSING! Gold Star Spouses Property Tax Exemption HCR21-1002 KILLED!

1002 to submitting a constitutional referendum to the public to add 140 surviving Gold Star Spouses to the state's Disabled Veteran Property Tax Exemption. To repeat, unanimous House vote. Colorado's state representatives merely wanted to give active-duty widows the same too-small exemption disabled veterans' survivors get.

SECOND FLASH: To prevent the embarrassment of a Senate vote where Colorado's voters would see who voted against these Gold Star Spouses, the Senate killed the bill last night in committee. Straight party line, thumbs down and the bill died. Republicans YES, but every Democrat NO. I guess cautious senators felt Colorado would be overburdened if we didn't continue to ignore our dead soldiers' spouses.

I've been interested in advancing the Gold Star Wives property tax exemption for many years, urging action through the United Veterans Coalition. I've recently set the issue aside and for the UVC and Gold Star Wives to address the exemption for themselves – perhaps too much from me when I'm not a Gold Star spouse, only a Gold Star son.

Anyway...shot down behind closed doors. It feels like something's backwards here, as I'd have expected Democrats to have more concern than Republican. This was a vicious slap in the face to the House and to survivors of our troops who've died in the line of duty. The cost? Less than $94,000 according to Legislative Council Staff.