Colorado recognizes sacrifices of our totally disabled veterans, awarding a partial property tax exemption to 100 percent totally and permanently disabled veterans. The U.S. Department of Veterans Affairs has two types of 100% disabled veterans – (1) vets with a 100% disability (2) vets with a total disability rated “Total Disability for Individual Unemployability” (TDIU.) VA benefits for the two types are identical, but Colorado’s TDIU veterans are unfairly denied the exemption

Monday, February 20, 2023

A DISABLED VETERAN AND MILITARY RETIREE LOOKS AT HB23-1084 -Continuation of Military Retirement Benefit Deduction in Colorado

Saturday, August 14, 2021

The legislature hid their cards from us with Referendum E in 2006

In 2006 the legislature referred an issue to the public for a small property tax

exemption for totally and permanently disabled veterans. This was done via SCR06-001. But the legislature hid some of their cards, not telling us all the details, so what we approved was not what we got!

This issue reached the voters as Referendum E in 2006 and was then overwhelmingly approved. Colorado voters believe in protecting our disabled veterans with such important benefits!

The legislature then created "enabling legislation" in the form of HB07-1251 to set into our statutes the provisions of the newly-approved Referendum E.

That sums up the trouble we now have in our state's small disabled veteran property tax exemption.

You see, we were asked to vote on a straightforward text the legislature gave us in the Blue Book:

"AN AMENDMENT TO SECTION 3.5 OF ARTICLE X OF THE CONSTITUTION OF THE STATE OF COLORADO, CONCERNING THE EXTENSION OF THE EXISTING PROPERTY TAX EXEMPTION FOR QUALIFYING SENIORS TO ANY UNITED STATES MILITARY VETERAN WHO IS ONE HUNDRED PERCENT PERMANENTLY DISABLED DUE TO A SERVICE-CONNECTED DISABILITY."

We didn't see the cards the legislature hid behind up their sleeves (or is it behind their backs?) They didn't show us anywhere in the Blue Book that SCR06-001 also had a description of the qualified disabled veteran that, in effect, eliminated almost half of Colorado's veterans who'd been totally and permanently disabled in the line of duty. They didn't tell us anything about their description in what we approved, but they certainly put their hidden cards into Article X Section 3.5 and the enabling statute HB07-1251:

(1.5) For purposes of this section, "disabled veteran" means an individual who has served on active duty in the United States armed forces, including a member of the Colorado national guard who has been ordered into the active military service of the United States, has been separated therefrom under honorable conditions, and has established a service-connected disability that has been rated by the federal department of veterans affairs as one hundred percent permanent disability through disability retirement benefits or a pension pursuant to a law or regulation administered by the department, the department of homeland security, or the department of the army, navy, or air force

The words in highlighted yellow cut thousands of Colorado's totally and permanently disabled veterans, injured in the line of duty and with honorable service, from the property tax exemption we thought we approved for them. We never saw and we never approved those words or anything like them!

The VA has two types of disability ratings for veterans who are totally and permanently disabled in the line of duty. One is called "100% rated" and the other is "Total Disability for Individual Unemployability," or TDIU.

Both ratings are based on the fundamental concept in the VA for compensation based the degree of an injury's impact on the veteran's ability to earn a wage after service:

• The "100% rated" is based on standard tables for the average earning loss caused by the average injury.

• "TDIU" is based on the actual earning loss caused by a worse-than average injury. A TDIU veteran has been individually assessed by VA as having an especially worse-than-average injury rendering him/her actually unable to ever work again.

Colorado's voters thought we were voting for, as the Blue Book put it for us to better understand:

"Veterans are rated 100-percent permanently disabled when a mental or physical injury makes it impossible for the average person to hold a job and the disability is lifelong"

Colorado's legislators and administrators would have us accept that 100% is not the same as total. That the amendment and the statute exclude TDIU veterans with total and permanent disabilities but accept 100% veterans with total and permanent disabilities.

Folks, the legislature simply hid their cards....or did they have them up their sleeves?

We didn't get what we voted for. We didn't protect all the veterans we thought we were protecting with Referendum E!

Saturday, June 26, 2021

June 26: American Legion Votes Support of Gold Star Wives Property Tax Exemption

The resolution initiated with the Legion post in Fort Collins.

The Legion's resolution urges UVC to include the issue in its 2022 state legislative agenda. The coalition's agenda is yet be finalized. Obviously the legislature itself must agree to a solution during the next session.

Left unclear is whether a constitutional amendment or an act of the legislature will be the preferred approach.

The Legion's approved resolution joins that of the Military and Veterans Affairs Committee of the Colorado Bar Association, plus our own from the C-123 Veterans Association. It remains for the Gold Star Wives, not third parties, to actually initiate UVC consideration of this issue.

(click: resolution of American Legion Department of Colorado)

Sunday, June 13, 2021

How'd that Colorado Senate vote go for Gold Star Wives' property tax exemption?

June 7 2021: HOW DID COLORADO STATE SENATORS VOTE TO PERMIT GOLD STAR WIDOWS THE SAME PROPERTY TAX EXEMPTION COLORADO GIVES DISABLED VETS' WIDOWS? One Guess. | |||

| DEMOCRATS = 100% NO GOP = 100% YES Interesting. And very, very revealing. Every senator* who voted "YES" to honor our Gold Star Wives with SJR21-010 in May seemed to see things differently on June 7, and voted "NO" on HCR21-1002. Thumbs down on spending $93,000 to permit these 140 widows of active-duty troops same small partial property tax exemption Colorado now gives survivors of our 100% disabled veterans. Here are their empty words from SJR21-010 tossed to the wind, now shown to be useless and meaningless: "That we, the members of the Colorado General Assembly honor the pride and the pain of the parents and partners and children and siblings of our fallen heroes and recognize the families of these proud patriots with an expression of profound gratitude and respect." * voting no:

|

Monday, May 31, 2021

THE BIG PROBLEM: How to pay for TDIU Vets Getting the Disabled Veteran Property Tax Exemption

In Colorado's state house that is the Number One question on every bill. Trying to get the Disabled Veteran Property Tax Exemption to cover VA 100% permanent Total Disability for Individual Unemployability (TDIU) vets will be no different.

I don't know the necessary procedures but will float a couple ideas here. First, the goal is to get the exemption for approximately 4622 veterans now rated 100% disabled TDIU by the VA. That's approximately $2.6 million added to the overall Homestead Exemption program costing over $159 million.

Currently, veterans and their survivors are only 2% of that total with the exemption restricted to VA 100% schedular vets, so adding TDIU will make veterans just under 4% of the program. The number of vets that I use already considers the fact that 13.3% are also able to claim the senior exemption, and already factors in the point that 80% of all the Colorado TDIU vets own homes to exempt. Finally, the average value of each exemption is considered, leaving the goal at $2.6 million.

The Legislature needs to appreciate that voters already approved every 100% disabled veteran for the Disabled Veteran Property Tax Exemption. The wording of Referendum E in 2006 was very clear, as was the explanation in the Blue Book. It was the legislators, not the voters, who opted with the enabling legislation for Article X Section 3.5 to invent the unemployability barrier. We need to.get our tax laws back into line with the state constitution!

– POSSIBILITIES –

1. Cut the average veteran and survivor exemption benefit in half to stretch the present funding to include TDIU recipients. The Legislature already has the power to do this per Article X Section 3.5 of the state constitution

2. Likewise, reduce the benefit to each senior homestead exemption to capture $2.6M. This would be a much less severe reduction for the recipients than #1 above, approximately 0.02 for about just $11 less per year per exemption

3. Divert a portion of the funds CDMVA now uses for grants

3. Add an optional $5 contribution to each state income tax return

4. Divert $2.6M from Colorado Economic Development Commission

5. Ideas??

Saturday, May 29, 2021

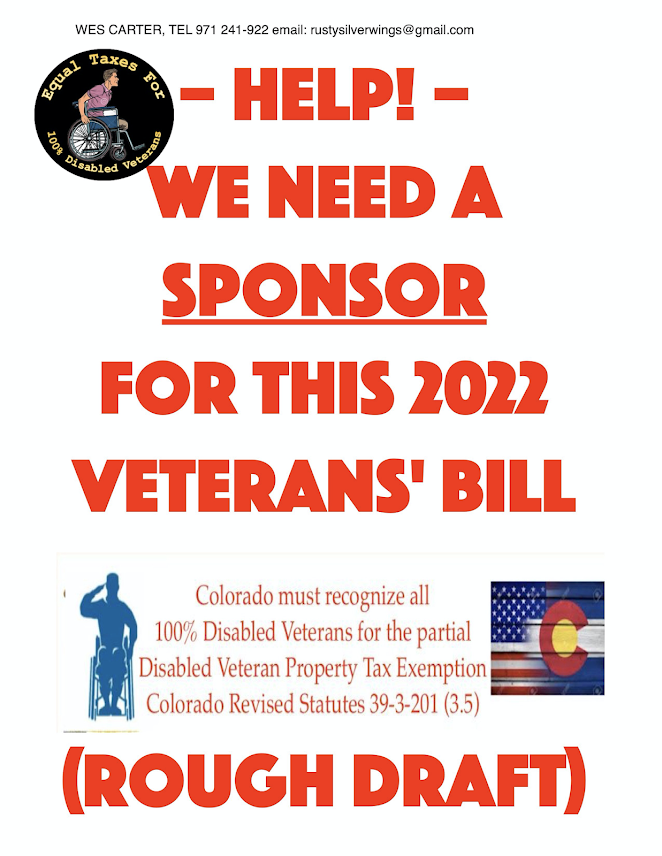

Colorado Legislature: Sponsor Needed for 100% Disabled Veteran Property Tax Exemption

= Equals =

100% VA Total & Permanent Line of Duty Disability

Friday, May 28, 2021

Colorado Legislature: Sponsor Needed for 100% Disabled Veteran Property Tax Exemption

Thursday, May 27, 2021

Colorado Legislature: Sponsor Needed for 100% Disabled Veteran Property Tax Exemption

Thursday, May 13, 2021

Seeking support within United Veterans Coalition for Gold Star Wives Property Tax Exemption

Given that Colorado's United Veterans Coalition requires unanimous agreement on a legislative objective, it seems best to begin asking the various member organizations for a chance to discuss Gold Star Wives property tax exemption. As I understand the process, issues are put forward in June to begin consideration and the agenda is decided upon in November.

The American Legion has already advanced its resolution asking UVC to consider the Gold Star Wives property tax exemption. Efforts are also underway to discuss the issue with other groups. UVC has to balance the many concerns it faces, and Gold Star Wives property tax exemption is but one that bears discussion.

That discussion has already begun with some veterans' organizations and will continue by reaching out to each organization's UVC member representative. Their input is important but the only suggestion thus far is to limit the effort within UVC, respecting its role as the principal voice of Colorado's 460,000 veterans.

It is still unclear about whether a constitutional or legislative solution will be required, but a couple drafts for both approaches are ready for review. Hopefully, the legislature can act and avoid the difficult process of a constitutional amendment. That's a question for the Legislative Council Staff or the Office of Legislative Legal Services but not right now: As with meeting with our legislators, it is necessary to wait until this very busy session wraps up in early June.