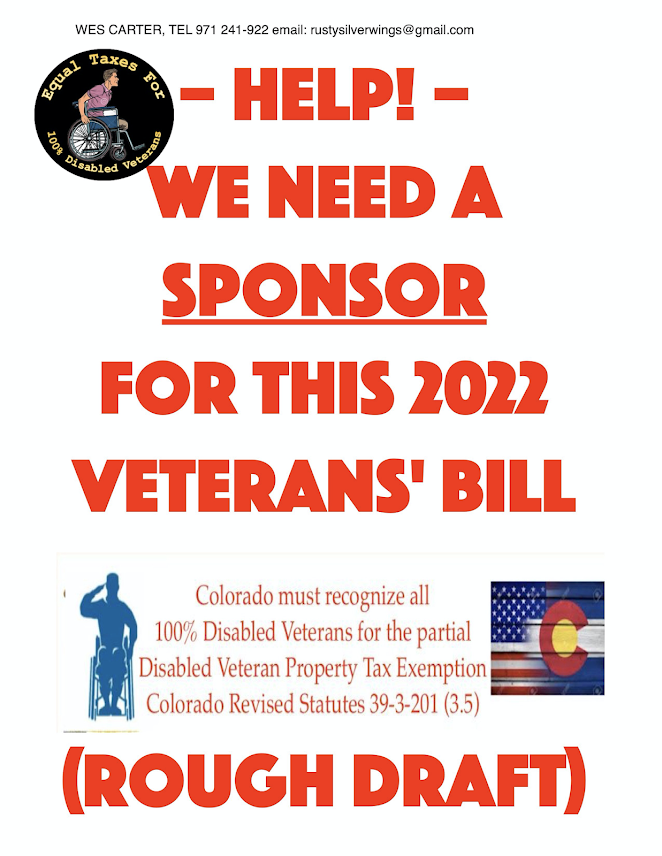

It’s hard to believe. Over this last

decade state officials simply ignored property tax provisions spelled out in Colorado’s

constitution to provide a small exemption to totally disabled troops retired by

the military for line-of-duty injuries. It’s like the law simply went missing

in action.

Back in 2006 voters amended our

constitution, approving by a four-to-one margin to provide a small,

partial property tax exemption. Only about $480 on average, the exemption is

for two categories of injured servicemembers: Troops retired by the military as

totally and permanently, and second, veterans rated 100% totally and

permanently disabled by the Department of Veterans Affairs.

Referendum E carefully addressed both of the above categories because there are three differences between them:

1. Not all disabled

military retirees also seek a VA disability rating – ratings must be applied for

2. Although based on similar laws, often military retirees face years of delays with claims and appeals to receive VA ratings, but military disability retirements are effective immediately upon leaving active duty

3. The military views a disability as medically unable, through line-of-duty illness or injury, to perform one's military specialty or be retrained in another; VA views disability as the percentage of loss of capacity to work in meaningful employment, somewhat similar to Social Security disability rules

(real example: Northern Colorado resident Vietnam-era veteran medically retired as 100% by the military in 1991 because of Gulf War injuries. Filed VA claims for numerous 100% disabling injuries and Agent Orange illnesses in 1992-1994 but not finally approved for 100% VA disability rating until 2015. Per our constitution's Article X Section 3.5, this veteran was eligible for Colorado's disabled veteran tax exemption in 2007. As of December 2017, still no state web site instructions or forms permit his application because only federal VA 100% disability ratings are mentioned, not his 100% military medical retirement.)

Problem: Through an oversight when the 2007 statute was drafted, the category

of totally disabled military retirees was simply not mentioned…language about

them is in the constitution, but was absent from the text of the law.

In 2015 concerned citizens discovered

this missing language issue and asked the legislature to align the constitution

with the statute. Both houses approved HB-1444 unanimously and it was signed into

law in May 2016.

And it has been simply ignored since

then.

Here's the law describing the partial

tax exemption. The bold type was left out of the enabling statute:

“(3.5) ‘Qualifying disabled

veteran’ means an individual who has served on active duty in the United

States armed forces, including a member of the Colorado National Guard who has

been ordered into the active military service of the United States, has been

separated therefrom under honorable conditions, and has established a

service-connected disability that has been rated by the federal department of

veterans affairs as one hundred percent permanent disability through

disability retirement benefits pursuant to a law or regulation administered by

the department, the United States departments of homeland security, Army, Navy,

or Air Force.”

|

| May 2016. Governor signs HB16-1444. I'm on right. |

Now the statute has been repaired,

the missing words added to comply with the constitution. However, there's a problem with

the way the law finally gets administered: Colorado officials simply haven't

gotten around to its section addressing totally and permanently disabled

military retirees so they’re still denied their property tax exemption. Officials never changed the application forms, the

rules or the instructions.

The governor signed HB16-1444, an act unanimously approved

by both houses of the legislature in May 2016 and placed those missing words from

the constitution into the law, effective June 2016. His signature has been

ignored, and without any constitutional or legal authority at all, totally

disabled military retirees continue to be taxed and their rights abused.

When I've discussed this taxation disconnect

with officials there's no disagreement about the problem. They just don’t see ignoring

it as a big deal.

This is a big deal! The constitution

expresses people’s will. Officials from the governor on down have sworn to

protect and defend it. A constitutional provision like this can’t simply be

ignored. You may recall that in 1776 unfair taxation led to some disagreement

between England and her American colonies.

Now that this problem has been

pointed out to state officials, they’ve indicated rules and application forms might

be set right by January 2018. But that’s so very late, especially considering

the constitution provided their exemption effective ten years ago.

Few Coloradoans tolerate being

wrongfully taxed. We owe these veterans so much more than this small tax

exemption they’ve earned through disabling line-of-duty injuries. Colorado has no

excuse for failing to provide it.

These veterans have been patient long

enough. The constitution has been ignored long enough.