I've needed to go into an explanation what VA TDIU is (CLICK HERE for VA's factsheet) but I overlooked doing it until questions arose at Sunday night's United Veterans Coalition banquet in Denver. A gentleman at our table was from Arapaho County and asked me about helping his Army veteran son.

A skillful veteran’s service officer (VFW, DAV, state or county) can advise about eligibility for Total Disability for Individual Unemployability (TDIU, and sometimes just IU) and help one obtain this valuable benefit if qualified. These pros know the mysterious VA bureaucracy and the evidence required to obtain favorable benefit claim decisions for disabled veterans. Their objective for every disabled vet they assist is to get the maximum entitled benefit. And actually, that's VA's goal as well.

The VA requires veterans to prove their qualifications for disability benefits but even then, VA routinely denies legitimate TDIU claims.

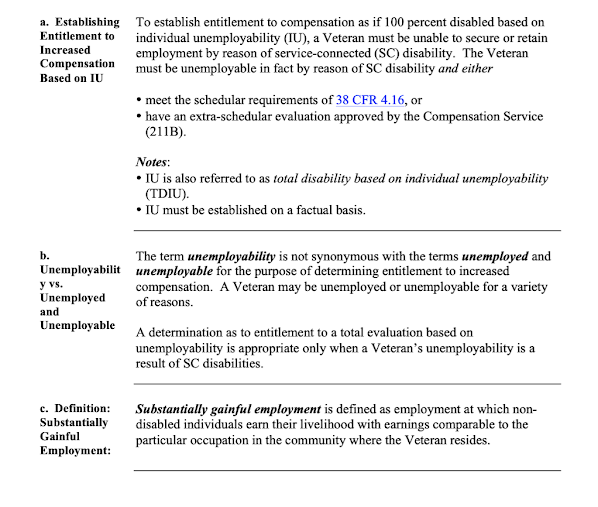

Qualifying for TDIU:

The VA’s Individual Unemployability (TDIU) benefit represents somewhat of a loophole for disabled veterans in the VA system. It allows assigning a total disability rating for compensation (100%) to to a vet when the vet’s actual disability exceeds the VA's rating chart. TDIU was established decades ago when VA appreciated that there were situations where the regular percentage allowed for a disability is inadequate and where the vet's particular disability (regardless of any rating chart) is in fact total. TDIU ratings account for situations where the line-of-duty disability has made employment impossible, making employment impractical.

Total Disability for Individual Unemployability is based on the vet’s proven inability to maintain “substantially gainful employment” due to a service-connected illness or injury.

VA regulations usually require the vet to have at least one service-connected disability rated at 60% or more. Or, if the vet has multiple disabilities, at least one must be ratable at 40% or more, and in combination the vet’s disabilities confer a combined rating of 70% or more.

Veterans who do not meet the minimum disability percent rating requirements for IU may be considered if they can show exceptional or unusual circumstances, such as that their disabilities directly interfere with their employability or require hospitalization often enough to make steady employment impractical. Or, that a secondary issue such as pain from an SC back injury makes competitive employment painful and unwise to attempt.

The veteran’s claim must show that service-connected disability or disabilities are “sufficient, without regard to other factors, to prevent performing the mental and/or physical tasks required to get or keep "substantially gainful employment.”

“Substantially gainful employment” is defined as “employment at which non-disabled individuals earn their livelihood with earnings comparable to the particular occupation in the community where the veteran resides.”

VA regulations also make it clear that substantially gainful employment is more than marginal employment, which is a secondary standard for evaluating a vet’s earnings. Marginal employment is defined as earning income that does not exceed the poverty threshold for one person as established by the Census Bureau. For 2021, that threshold is $13,100 for an individual under age 65.

Vets in sheltered work environments, employed by family businesses or self-employed may earn more than marginal employment income and still be considered for IU.

Money earned by participating in the Veterans Health Administration’s (VHA’s) Compensated Work Therapy (CWT) Program is not counted as income for TDIU purposes.

A vet who has a 100% disability rating according to the VA rating schedule is permitted to maintain substantially gainful employment, but an TDIU benefit recipient is not.

TDIU benefits parallel those of 100% schedular. The compensation is the same with identical special allowances for dependents, clothing, aid and attendance, travel, and special monthly compensation. A prepaid $10,000 is available upon application. Rehab, pharmacy, audiology, prosthetics, optometry, and other VA medical care is the same. There are some situations where dental care is also provided. One of the most important benefits for both TDIU and 100% schedular is CHAMP-VA for Tricare-like family medical care. Often with age and increasing difficulties with SC issues, a TDIU-vet will transition into 100% schedular.

VA TDIU Eligibility Requirements:

Evidence that must be part of a veteran’s disability benefits claim to obtain IU / TDIU benefits includes:

• Medical evidence of the veteran’s current physical and mental condition, e.g., results of VA examinations, hospital reports, and/or outpatient records. As in other claims, the VA may schedule a medical examination if the veteran’s medical evidence is incomplete or inconsistent.

• Employment and work history for five years prior to the date on which the veteran became too disabled to work, as well as for any work performed after this date.

• Forms completed by each employer for whom the veteran worked during the 12-month period prior to the date the veteran last worked.

• Social Security Administration reports if the vet receives Social Security Disability benefits, if the veteran’s other evidence is insufficient to award compensation

• Records from the VA’s Vocational Rehabilitation and Employment Service (VR&E) if evidence suggests rehab was undertaken but unsuccessful or was found to be medically unfeasible. VR&E testing can be requested by any vet enrolled in VA health care. Social Security Disability records are persuasive.

If the TDIU benefit is granted, the vet must complete a VA employment questionnaire each year until the age of 69 to affirm that he or she remains incapable of maintaining substantially gainful employment.

VA disability raters are trained to consider TDIU in exceptional cases, yet about 40% of all totally disabled vets get that rating and 60% or so are 100% schedular. Examiners can't consider the vet’s age or distinguish between retirement and inability due to age as opposed to a true service-connected disability resulting in unemployability.

As in other cases, VA claims examiners may request additional information at any time to supplement or clarify evidence in a veteran’s claim. This, of course, slows the process. Submit as much persuasion as can be gathered!

Good luck with your claim. NOW – HELP OTHER VETERANS!