On Wednesday the United Veterans of Colorado met with legislators who sponsored last years' constitutional amendment adding Gold Star Spouses to the property tax exemption. We're grateful for their outstanding leadership, especially from Representative Cathy Kipp!

Colorado recognizes sacrifices of our totally disabled veterans, awarding a partial property tax exemption to 100 percent totally and permanently disabled veterans. The U.S. Department of Veterans Affairs has two types of 100% disabled veterans – (1) vets with a 100% disability (2) vets with a total disability rated “Total Disability for Individual Unemployability” (TDIU.) VA benefits for the two types are identical, but Colorado’s TDIU veterans are unfairly denied the exemption

Friday, March 31, 2023

Wednesday, May 4, 2022

GOLD STAR SPOUSES PROPERTY TAX EXEMPTION ADVANCES TO SENATE FLOOR

Yesterday the Colorado Senate Appropriations Committee voted unanimously its approval of the Gold Star Spouses property tax exemption bill. Several senators on the committee spoke to the importance of this bill.

Once approved by the Senate and signed by the governor, the bill goes to voters in each senatorial district as a referendum on amending the state constitution to include Gold Star Spouses for the partial property tax exemption. Presently, survivors of totally disabled vets already receiving the exemption continue the exemption. The original language of the property tax exemption unfortunately didn't address the situation of servicemembers who die on active duty.

Tuesday, April 12, 2022

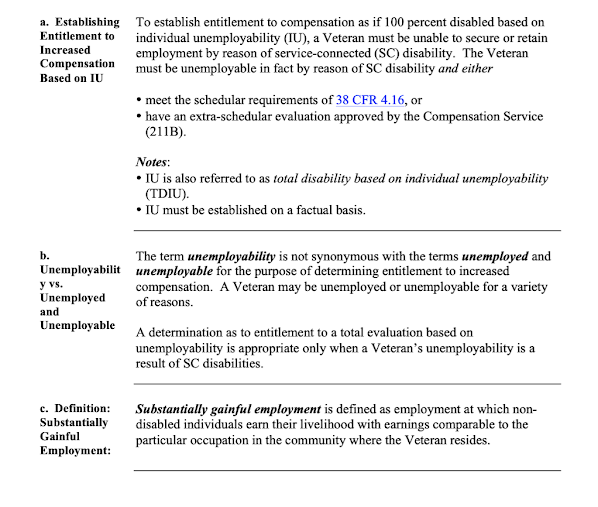

TDIU = actual VA TOTAL disability rating

A previous director of the Colorado Division of Military and Veterans Affairs wrote me six years ago to state that one reason Colorado denies TDIU veterans the state partial property tax exemption is that the state law requires a VA TOTAL DISABILITY RATING, and he explained that TDIU is somehow "only" compensation at the 100% rate and not an actual disability rating.

CDMVA hasn't made any visible effort to care for TDIU veterans the same as it cares for 100% schedular. A variety of reasons have been tossed out but as for TDIU being an actual disability,VA disagrees with CDMVA.

From Title 38, Chapter 4 (§ 4.15 Total disability ratings)

"It is the established policy of the Department of Veterans Affairs that all veterans who are unable to secure and follow a substantially gainful occupation by reason of service-connected disabilities shall be rated totally disabled"

Tuesday, August 24, 2021

UVC Identifies 2022 Veterans' State Legislative Objectives

Colorado's Total Disability for Individual Unemployability (TDIU) veterans' property tax exemption was selected as the coalition's Number Two goal going into the next legislative season!

Both objectives deal with Colorado's Constitution, Article X Section 3.5 and the small partial property tax exemption presently offered seniors, totally and permanently disabled veterans, and their survivors.

The Colorado Bar Association had already indicated its support for both objectives.

Co-chairs Shelly Shelly Kalkowski and Robbie Robinson presented their state legislative committee 2022 general goals and specific objectives, finalized just prior to this morning's executive committee gathering.

Thank you, UVC!

Tuesday, August 17, 2021

Colorado DAV asked to lead the way on TDIU property tax exemption effort

Saturday, August 14, 2021

Doesn't ANYBODY in Colorado care about TDIU Veterans?

Outside of those two worthy organizations who "really get it"...zero interest among Colorado's citizens for the needs of the state's totally and permanently disabled veterans of honorable service who are rated "TDIU."

Not your problem, right? You're probably not a vet although perhaps the child or grandchild of one. You're probably not the father of a young man or woman in service. So...simply not your problem.

TDIU veterans make up about 30-40% of Colorado's totally disabled veterans. VA has two categories: 100% rated, for vets whose injuries are typical for the type injury suffered, and TDIU, for vets whose injuries are worse than typical for the type injury suffered.

Colorado permits the 100% rated vets our too-small partial property tax exemption, and specifically refuses it to TDIU veterans.

Are these veterans any different than each other? Yes, because the TDIU vet is specifically evaluated as having a worse-case type injury rather than "typical," and is thereby totally and permanently disabled and never able to work again.

Why do we treat them differently? Ask your legislator if they can explain...I can't. I care, but only a rare handful in the legislature seem to care.

Not their problem. They really don't care.

Tuesday, August 10, 2021

Is there any real value to the Disabled Veteran Property Tax Exemption?

Is the Disabled Veteran Property Tax Exemption actually worth anything?

Easy answer: not as much as when voters approved it back in 2006.

The US dollar has dropped in value by other a third. Our 2006 dollar has lost 35 cents, while the exemption has remained static (half of the first $200,000 in assessed value) since creation in 2006.

The value of the exemption voters approved for disabled veterans is worth much less today. While property values, property taxes and other expenses keep going up each year, the real value of the property tax exemption for disabled veterans, seniors and their survivors, is worth less and less each year as we watch the dollar deflate. And property taxes in real dollars keep going and up

The 2020 cost to Colorado for all categories of the property tax exemption was about $159,000,000. Disabled veterans and their survivors are only 2% of that.

Colorado isn't especially generous in our exemption. Nineteen other states exempt 100% of a totally disabled veteran's property taxes. No other state restricts TDIU veterans from their exemption.

"They just did it." Used statute to modify Article X Section 3.5 & added survivors

GOLD STAR WIVES:

HB14-1373 added surviving spouses of seniors and disabled veterans to the property tax exemption in Article X Section 3.5.

That means the legislature modified a provision in the Colorado constitution without bothering with an amendment!

Oops.

That is "extra-constitutional." But it was done. Can we do the same "extra-constitutional" approach to add Gold Star Wives (spouses) to the survivors?

Saturday, June 19, 2021

United Veterans Committee Crafting State Legislative Agenda for 2022. TDIU Veterans Issue Proposed to the Committee

The decision will be based on input from all levels of UVC organizational members. This is an issue I've advocated about for six years. I ask everyone to get behind this agenda item, voicing your support directly to the state legislative affairs committee and the executive committee as all such potential agenda issues are being weighed this summer.

Inclusion of TDIU veterans affects about 2,000 Colorado vet homeowners and survivors, at a cost to Colorado at about $2.6M. Voters originally approved the Disabled Veteran Property Tax Exemption as Referendum E in 2006. The Blue Book described the benefit for "totally disabled veterans unable to work" due to line-of-duty injuries and illnesses. Somehow, "unemployability" was written into the enabling legislation and statue after the amendment was approved. That's not what the voters thought we were approving.

I hope the legislature to include these ignored 100% disabled veterans by exercising its authority to redefine "qualified veteran." A revised statute can include TDIU vets.

Colorado utilizes VA definitions for management of veterans benefits, so it is very telling to see VA's own rules from VAM21-1 on TDIU. Read carefully, and compare to the language of Referendum E, the enabling statute and the Disabled Veteran Property Tax Exemption form and instructions.

As for Gold Star Wives, the Legislative Support Staff calculated the cost to Colorado would be only $93,000, so it is very, very hard to understand why every Democrat voted against these 140 Gold Star Wives' much too small a benefit.United Veterans Coalition Considering Agenda Item: Property Tax Exemption for Gold Star Wives

The United Veterans Coalition state legislative affairs committee is considering addition of the Gold Star Wives Disabled Veteran Survivor Property Tax Exemption for inclusion in the 2022 legislative agenda.

The United Veterans Coalition state legislative affairs committee is considering addition of the Gold Star Wives Disabled Veteran Survivor Property Tax Exemption for inclusion in the 2022 legislative agenda.

The decision will be based on input from the Gold Star Wives and other primary organization members. I encourage everyone having an opinion on the issue to voice it through their primary group representatives.

The issue was unanimously approved by the Colorado House in the session just ended but killed by the Senate Military and Veterans Affairs Committee. The idea was to submit a referendum to the voters next term, amending the constitution's Article X Section 3.5 to include these active-duty troops' survivors. I believe the change could have been made via statute, a much easier path than changing the consitution.

The Legislative Support Staff calculated the cost to Colorado would be only $93,000, so it is very, very hard to understand why every Democrat voted against these 140 Gold Star Wives' small benefit.

Tuesday, June 15, 2021

COLORADO SENATE SNUBBED FAMILIES – KILLED GOLD STAR WIVES' PROPERTY TAX EXEMPTION

|

| June 7 2021: Colorado Senate killed Gold Star Wives bill for given survivors of totally disabled veterans (HCR21-1002 |

Friday, June 11, 2021

COLORADO SENATE DISHONORS ITS OWN RESOLUTION "HONORING" GOLD STAR FAMILIES

Right. Uh-huh. Fellow Coloradans, SJR21-010 wasn't worth the postage to mail it to the survivors. Neither was it enough of "an expression of profound gratitude and respect" to move the mighty senators to more carefully consider HCR21-1002. It certainly wasn't worth the esteemed committee of law-makers' bipartisan review. Instead, on a party-line vote, all Dems voted NO and the outnumbered Republicans voted YES.

1. sell the marital home and downsize

2. reduce housing costs to adjust to loss of spouse's income

|

| SHAME |

exemptions just too, too much of a burden for the Great State of Colorado? No, not when we can also spend many millions on family planning for undocumented immigrants.

1. There are two types of Gold Star Wives. First, a small number of survivors of servicemembers whose deaths were in the line of duty while on active military service. This is the group proposed for the disabled veteran survivor property tax exemption.

Friday, June 4, 2021

Public Officials take an oath to support Colorado's constitution. What does that really mean?

frustration on this state issue. You see, in my world the oath was military; “support and defend” and we were trusted to do just that, regardless of personal hazards, difficulties, obstacles, etc. We were also carefully taught for decades that support and defense of the Constitution of the United States is our highest duty.

Lesson from the 1946-1948 Nurenberg trials? Orders from a superior that conflict are illegal. If laws, orders and regulations present a conflict, I must seek assistance from colleagues, higher authorities, the Judge Advocate General, or even resign if possible. If circumstances leave my resignation impossible, I am obliged to obey the Constitution as best I can understand it. Merely hiding behind an illegal or unconstitutional order would be no defense at all.

Web site after county web site, state web site after state web site, virtually every place one finds information about the Disabled Veteran Property Tax Exemption DOLA and CDMVA continue to ignore the constitution. DOLA has tried at least twice in the last five years to have counties update details about the exemption, but even the DOLA web site application and instruction forms continue to misinform veterans that a document showing VA 100% disability must be submitted. A disabled military retiree reading that simply doesn't bother going any further.

Wednesday, June 2, 2021

Very kind article from the National Veterans Legal Services Project

The National Veterans Legal Services Project (NVLSP) is a wonderful organization dedicated to America's veterans and our families. They just did a nice "puff" piece and video on me. NVLSP and its co-directors are acknowledged by the entire veteran community as instrumental in forcing VA to honor many commitments to veterans.

From military sexual trauma, immunizations, toxic exposures, unfair discharges, and many other causes have found NVLSP and its volunteer attorneys, law school veterans law clinics, and associated law firms to be powerful allies. Always pro bono.

NVLSP has never charged veteran clients for their service or even expenses. For example, they saved our C-123 Association over $75,000 just on fighting for FOIA responses, something the Air Force didn't seem eager to release.

NVSLP and Perkins Coie have represented us pro bono before the US District Court in Washington, successes that were noted by the Federal Bar Association in 2018, and at the USAF Board for Correction of Military Records. Bart and his colleagues are top-rated for their proper use of donations. NVLSP is one of the Combined Federal Campaign agencies. I encourage all veterans to consider helping other vets by donating here.

Wednesday, May 12, 2021

Colorado's abandoned 100% disabled veterans – those rated "Total Disability for Individual Unemployability (TDIU)"

VA has two kinds of total disability awards – "TDIU" for total disability for individual unemployability, and 100% service connected permanent and total.

VA may increase certain veterans' disability compensation to the 100 percent level, even though VA has not rated their service-connected disabilities at that level. To receive the supplement, termed an Individual Unemployability (IU) payment, disabled veterans must apply for the benefit and meet two criteria. First, veterans generally must be rated between 60 percent and 90 percent disabled. Second, VA must determine that veterans' disabilities prevent them from maintaining substantially gainful employment—for instance, if their employment earnings would keep them below the poverty threshold for one person.

Unhappily, our legislators really tightened up qualifications and locked out every single TDIU veteran. TDIU vets are carefully evaluated by VA, have at least one 60% permanent disability and a combination of factors making it physically impossible for them to work. Ever. Both vets are referred to as 100% VA disabled, but TDIU veterans have been refused the Colorado disabled veteran property tax exemption.

Consider the leeway given the legislature in the tax code. Clearly, the legislators had/have the power to follow Referendum E "in a manner that gives its words their natural and obvious significance." Must we suppose that totally and permanently disabled aren't "natural and obvious" enough words for TDIU?

Colorado Revised Statutes 2016, Title 39-3-202

TITLE 39(c) In enacting legislation to implement section 3.5 of article X of the state constitution the general assembly has attempted to interpret the provisions of section 3.5 of article X of the state constitution in a manner that gives its words their natural and obvious significance;

"Veterans are considered to have total disability when they have a 100 percent disability rating due to service-connected disabilities or if their service-connected disabilities make them unemployable. For the total disability to be permanent, the law requires the disability to be “based upon an impairment reasonably certain to continue throughout life.""The Veterans Benefits Administration Inadequately Supported Permanent and Total Disability Decisions",

LEGISLATIVE ACTION: Two possible changes to Article X Section 3.5 to add Gold Star Wives' property tax exemption

SECTION 1. In Colorado Revised Statutes, 39-3-202, amend 3 (3.5) as follows: 4 39-3-202. Definitions. As used in this part 2, unless the context 5 otherwise requires:(FIRST possible revision)

(b) The owner-occupier is the spouse or surviving spouse of an owner-occupier who previously qualified for a property tax exemption for the same residential real property under paragraph (a) of this subsection OR THE SURVIVING SPOUSE OF AN INDIVIDUAL WHO DIED IN THE LINE OF DUTY IN THE UNITED STATES ARMED FORCES OR IN THE COLORADO NATIONAL GUARD WHILE ACTIVATED FOR STATE CONTINGENCIES

SECOND possible revision)

(1.5) FOR PURPOSES OF THIS SECTION, "DISABLED VETERAN" MEANS AN INDIVIDUAL WHO HAS SERVED ON ACTIVE DUTY IN THE UNITED STATES ARMED FORCES, INCLUDING A MEMBER OF THE COLORADO NATIONAL GUARD WHO HAS BEEN ORDERED INTO THE ACTIVE MILITARY SERVICE OF THE UNITED STATES, HAS BEEN SEPARATED THEREFROM UNDER HONORABLE CONDITIONS, AND HAS ESTABLISHED A SERVICE-CONNECTED DISABILITY THAT HAS BEEN RATED BY THE FEDERAL DEPARTMENT OF VETERANS AFFAIRS AS ONE HUNDRED PERCENT PERMANENT DISABILITY THROUGH DISABILITY RETIREMENT BENEFITS OR A PENSION PURSUANT TO A LAW OR REGULATION ADMINISTERED BY THE DEPARTMENT, THE DEPARTMENT OF HOMELAND SECURITY, OR THE DEPARTMENT OF THE ARMY, NAVY, OR AIR FORCE. FOR PURPOSES OF THIS SECTION, AN INDIVIDUAL WHO DIES IN THE LINE OF DUTY WHILE IN THE UNITED STATES ARMED FORCES OR THE COLORADO NATIONAL GUARD WHEN ACTIVATED FOR STATE CONTINGENCIES IS DEEMED A DISABLED VETERAN PREVIOUSLY QUALIFIED FOR A PROPERTY TAX EXEMPTION

Sunday, May 9, 2021

SITREP: Report to the Colorado Gold Star Wives re: Disabled Veteran Survivor Property Tax Exemptiopn

Good evening,

I agreed to provide you an update of things of interest regarding the property tax exemption for Gold Star Wives. Here it is.

The first item is that some legislators and staff were of the impression Colorado might have upwards of a thousand survivors. This is wildly off from the estimate of 150 potential applicants that the Legislative Council Staff calculated in 2019 for Representative Kipp. With a modest budget impact of less than $100,000 this looks more and more reasonable.

I've asked for but haven't been able to get any information from UVC about GSW being a 2022 legislative objective, which is the timing you suggested when we spoke.

Their gentle suggestion seemed to be that I should back off but that it would be okay to stay tuned to UVC web info. Rather than being so uselessly passive, silent and merely hopeful, it seems more appropriate to remain proactive within UVC and also follow UVC guidance to keep my elected representatives advised. It seems useful to get coalition members informed and supportive of your exemption now so it can be presented in June and voted on by this November – if I understand the UVC timing.

To that end, my American Legion post and district submitted an internal resolution that, if approved at our June meeting, informs the UVC of the Legion's request for placement on the 2022 objectives. Nothing more explicit, and all within UVC channels. If it fails to get UVC behind it next year as well, at least there was an effort.

As you and I agreed, National Guard troops who die when activated for state contingencies are referenced in this Legion resolution. I spoke with Guard and DMVA folks about the issue: a Guardsman's surviving spouse is protected with something like DIC but more generous at about $2800/month. It would be an unlikely event but if it ever does happen it absolutely right that their spouses be protected!

As you can read, the resolution doesn't actually do much in that it only directs the Legion's UVC delegate to ask the coalition to consider GSW. Details are left for the professionals to iron out if/when/however the coalition wishes:

RESOLVED, by the American Legion Department of Colorado) that unremarried Gold Star Wives and unremarried surviving spouses of State National Guard members who die while activated by the Governor for State service, be included in the Disabled Veteran Survivor Property Tax Exemption because it is both necessary and proper, that the United Veterans Coalition be informed for this to be part of its state legislative objectives until acted upon with a goal of implementation before 2023

--

As a Gold Star Family Member (CW4 Hank Carter, WWII, Korea, Vietnam,) this means a lot to me personally! In different circumstances it could have been my own GSW mom or my wife to be affected. It would affect survivors of crewmembers I've lost: Paul, Gabby, The Gif, Larry, Turcottte, Art, Bill, Bob, Arch, Fred and others.

If anything, I'm more concerned about this now than at our UVC banquet a couple years back when I introduced you and David Ortiz to then-Congressman Polis and to VA acting Deputy Secretary Scott Blackburn (our speaker that night.) This illogical distinction between GSW and disabled vets must be eliminated. If it had been done properly from the exemption's launch, each GSW would have saved over $8000 by 2022!

Whenever you have the time, I'd appreciate a cup of coffee and some discussion. The clip below is what I did for an informative panel.

God bless!

Friday, May 7, 2021

Helpful advice – and a word of caution

For some years I've advocated for Gold Star Wives receiving the same property tax exemption provided survivors of our totally disabled veterans. I've been feeling somewhat better and picked up some steam and got onto the bandwagon (I treasure mixed metaphors) to plow ahead to get some interest among others.

That hasn't gone so well. Not only is it a difficult sell in a state economy battered by Covid, it is also just one concern among so many affecting veterans and our families. Fortunately, we in Colorado have our United Veterans Coalition to bring to bear 460,000 veterans' voices for legislators to hear,

The UVC does its job well. Their decades-long track record is proof. The inclusion of a multitude of our largest and smallest veterans' organizations is another proof of the trust placed in UVC by us as veterans. One voice, 460,000 addressing agreed-upon legislative objectives.

But things can still be difficult. I've been concerned about bringing the issue up with the veterans' groups and my elected representatives, hoping for inclusion of Gold Star Wives' property tax exemption in the UVC 2022 legislative agenda. That's been hard, with less enthusiasm that I'd expected, and also hard because UVC has its well-established way of doing things. I knew little about UVC objectives and how to get UVC support, but when I asked for updates to information given me in 2019 before starting these current efforts my emails and calls went unanswered. Of course, nobody owes me any response at all - we're all volunteers in these veterans' projects.

You know the phrase: "Lead, follow or get out of the way!" In the vacuum of responses to my inquiries, I found nobody to follow and so I started seeking interest from others. The basic step was clearly getting UVC "primary members" behind what would have to be the unanimous coalition approval. Although I certainly have no attitude about "get out of the way," I didn't grasp the friction that my trodding on others' turf would cause as I reached out to primary coalition members.

So doing what I've been doing hasn't gone too well with UVC and what they're doing. Their opposition to my concerns about Gold Star Wives (I'm a Gold Star Family Member) is perfectly understandable because they are the experienced lobbyists, chosen for their dedication and successes. GSW wasn't an objective in 2014, 2015, (it was an objective in 2016 as I asked), 2017, 2018, 2019, 2020 or 2022. They've mentioned to others that my urging for it to be a 2022 objective wasn't well-received.

I've appreciated their two emails of useful guidance after I directly asked them, " I guess I should just ask outright, should efforts on Gold Star Wives stop altogether? "

Okay. Hand gently patted and pushed away from the throttle. I take it the coalition's suggestion is to "follow the UVC legislative committee updates" to see if action happens to develop among member organizations before coalition approval in November Gold Star Wives' taxation. Also, the gentle inference is that approaching my legislators for interest in their help next year, and approaching groups like the Legion or Colorado National Guard wasn't helpful or welcome, thus the guidance instead of encouragement or advice to do ... anything.

Darn. I'd hoped, expected even, some hand-holding. Some guidance and encouragement. Referring back to their email of sixteen months ago was interesting, and the point was that I should have remembered it and been compliant with it. I guess I was influenced most by our leadership's 16 Nov 2016 instruction:"it is crucial that each of you reach out to your own State Senator and Representative, and at least let him/her know that you are part of the UVC, and talk about how important it is that we support our veterans,

Oh, well. Lesson learned about playing nice with others.

Wednesday, May 5, 2021

"...in keeping with our legislative agenda" - United Veterans Coalition Champions Veterans' Issues for Colorado. When the time is right, Gold Star Wives' concerns WILL be heard!

At the right time,, I'm hopeful these thousands of veterans will be convincing our General Assembly that Gold Star Wives should be eligible for the Disabled Veteran Survivor Property Tax Exemption.

But this just isn't the right moment for GSW property tax issues. The benefit will be sought in the near future, just not right now. And it wasn't right back in 2016 when our state legislative agenda included Gold Star survivors but no traction was found, not even a draft bill.

UVC is "the tip of the spear" for our state's veterans. Speaking as one voice, coordinating dozens of organizations state-wide. VFW, DAV, American Legion, PVA, MOAA, NCOA, ROA, AFSA, VVA, and so many others of which I'm not a member – Submarine Veterans, Gold Star Wives - if an association serves vets and their families, if an organization promotes the national defense, they're a welcome part part of UVC and their concerns are heard. The various needs and propositions are discussed by the membership, and those agreed by UVC are delivered to the decision makers, both state and federal, in the form of the annual focused UVC legislative objectives.

Legislators in Denver and Washington listen carefully, hearing those thousands of UVC voices when the United Veterans Coalition speaks. Whether addressing an individual legislator, senate or house committee, or public forum like a town hall meeting or city council, the United Veterans Coalition commands attention, and rightfully so.

I know this. On a few occasions, I was a witness before the National Academies of Science or one of the house or senate committees, and authorized to speak on behalf of the UVC. UVC was firmly behind me as I sought Agent Orange benefits for C-123 veterans. We got all of Colorado's senators and congressional representatives together to pressure the VA, even to block presidential nominations from consideration until VA acted. Finally, we won on the merit of the issue and UVC strength.

We won the four year battle and gained VA Agent Orange benefits for 2500 Air Force C-123 aircrew, maintainers and survivors. Until Congress acted on the Blue Water Navy group, this was the only time VA added a new Agent Orange exposure group, and the only expansion of Agent Orange benefits since 1991. With HB16-1444 we won property tax exemptions for Colorado 450 military retirees and their survivors who'd been medically separated from their service as 100% disabled, and in doing so we brought the legislation into agreement with our state constitution's Article X Section 3.5.

Not only does the UVC present veterans' concerns to our legislator, UVC also prioritizes the multitude of issues and forms an annual legislative agenda for both state and federal issues.

The UVC legislative agenda is already firmly set for 2021, but has yet to be finalized for 2022. Whether or not Gold Star Wives' property tax exemption is identified as an objective is up to the primary members and lobbyists of UVC. The coalition sorts out our needs, identifies the possible, and prioritizes them. Presto, the annual legislative agenda.At the right time, Gold Star Wives' property tax issue is likely to be addressed by the coalition. Admirably, the GSW members are patient and understanding, with full confidence in the coalition.

The timing for GSW isn't right for 2021. Complexities of state budget, coalition priorities. Strategy and resources – all must align, and then UVC will deliver for the members of Colorado's Gold Star Wives. Let's get together for Gold Star Wives' proper place on the UVC 2022 legislative agenda!

Friday, April 30, 2021

Sample Association resolution: "Extend Disabled Veterans' Survivor Property Tax Exemption to Gold Star Spouses"

Here's what has been proposed to the American Legion, although in no way approved yet It needs post approval, then district, before the Department of Colorado can decide on it. Again. only a draft. (May 5: modified to forward the resolution only to UVC for them to consider.)

=====================================