FIRST, background on the two VA 100% disability ratings. One is straightforward – total disability rating based on one or more service-related injuries that total 100%. The other is less simple – it is "Total Disability for Individual Unemployability" – TDIU. The VA treats them equally, except the TDIU veterans are specifically rated for, and verified for, a permanent inability to work based on their totally disabling service-connected injuries.

NEXT, how will we do this? Along with the Military and Veterans Affairs Committee of the Colorado Bar Association, we feel Colorado should include 100% totally disabled veterans awarded VA total disability for individual unemployability (TDIU) in the definition of "qualifying disabled veterans for a property tax exemption for qualifying seniors and disabled veterans." by amending 2018 Colorado Revised Statutes, Title 39 - Taxation Property Tax, Article 3 - Exemptions, Part 2 - Property Tax Exemption for Qualifying Seniors and Disabled Veterans § 39-3-201. Legislative declaration.

(Universal Citation: CO Rev Stat § 39-3-201 (2018))

I'lI refer in my writing the US Department of Veterans Affairs' terminology because Colorado took took specific steps with HB16-1125 to align our state terms with the VA. I take note of the fact the VA's official TDIU phrase is is "total disability rating for compensation based on unemployability of the individual."

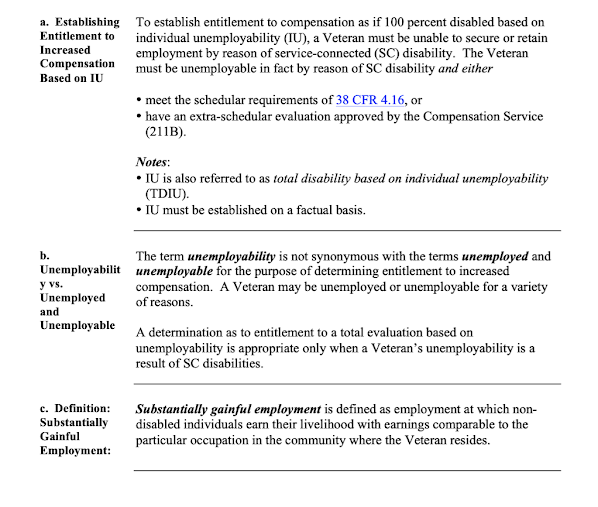

"Individual unemployability may be established when a veteran is unable to secure or retain employment by reason of a service-connected disability or disabilities. A veteran may be unemployed or unemployable for a variety of reasons. When VARO staff deem a veteran is unemployable due to service related disabilities, the veteran is entitled to Individual Unemployability (IU) benefits. In such cases, disability compensation payments are elevated to the 100 percent rate even if the medical condition(s) are evaluated as less than 100 percent disabling. In order to continue disability payments at the 100 percent rate based on TDIU, veterans must confirm annually that he/she continued to be unemployed for service-connected medical issues.

"To be considered for TDIU P&T status, the law requires veterans to have a “total disability permanent in nature.” Veterans are considered to have total disability when they have a 100 percent disability rating due to service-connected disabilities or if their service-connected disabilities make them unemployable. For the total disability to be permanent, the law requires the disability to be “based upon an impairment reasonably certain to continue throughout the life of the veteran."

Statistics: Of all its veterans with a VA TDIU disability rating (355,000,) VA reports Colorado has approximately 4077 potential TDIU claimants under age 65. If qualified for the exemption there'd be an additional annual impact to Colorado's budget of $2,642,000. Colorado isn't being particularly generous, considering sixteen other states waive waive all property taxes for totally disabled veterans; none have TDIU restrictions – except Colorado.) Our state ranks an unimpressive 27th in the value of veterans' state benefits.

More stats: The Census Bureau reports that the veteran population declines about 2.5 million each year, thus Colorado's 4622 potential TDIU claimants can be expected to decline at about the same rate, for a small reduction in the fiscal impact each year.

• With our wars winding down, both types of VA 100% disability ratings will also decline. Using Census and VA data, we can expect new veterans with 100% disabilities to be less than 75% of what we've suffered annually since the First Gulf War.

• Not only will there be fewer exemption claimants because of the veterans' aging population and because of a smaller US military, but there will be also fewer additions to our number of totally disabled veterans than we've seen these last twenty years. This reflects moving from combat plus peacetime training to peacetime disabilities alone.

VA treats its two types of 100% VA disability groups the same, and Colorado does not. We offer veterans with a 100% permanent and total disability the state's partial Disabled Veteran Property Tax partial exemption, but someone added specific language to the program that bars all TDIU vets from the benefit that's worth, on average, only about $640 a year. While homestead exemptions for seniors will be increasing as the population ages, disabled veteran and veteran survivor exemptions will decrease slightly, unless America's overseas wars return to plague us.

(Note: 57% of TDIU vets are older than age 65. Compared to 100% schedular vets, they are somewhat younger. Older Veterans could be encouraged to chose between Disabled Veterans eligibility or the senior citizen homestead eligibility (13% qualify for both) but there'd be no real change to the state budget.

We voters authorized the disabled vet property tax exemption by approving Referendum E back in 2006. Reading the text of the proposed constitutional amendment understandably has most of us believing that every veteran with a VA 100% permanent disability rating is qualified for the exemption: "AN AMENDMENT TO SECTION 3.5 OF ARTICLE X OF THE CONSTITUTION OF THE STATE OF COLORADO, CONCERNING THE EXTENSION OF THE EXISTING PROPERTY TAX EXEMPTION FOR QUALIFYING SENIORS TO ANY UNITED STATES MILITARY VETERAN WHO IS ONE HUNDRED PERCENT PERMANENTLY DISABLED DUE TO A SERVICE-CONNECTED DISABILITY.

The Blue Book expanded on this, just in case citizens couldn't fully understand we were considering 100% disabled veterans:

Who qualifies for the tax reduction? Homeowners who have served on active duty in the U.S. Armed Forces and are rated 100-percent permanently disabled by the federal government due to a service-connected disability qualify for the tax reduction in Referendum E. Colorado National Guard members injured while serving in the U.S. Armed Forces also qualify. Veterans are rated 100-percent permanently disabled when a mental or physical injury makes it impossible for the average person to hold a job and the disability is lifelong.

Later, language was mysteriously added to the enabling statute and regulations by the legislature to specifically bar totally disabled vets with TDIU. DOLA explained this was "the request of some legislators:" "VA unemployability awards do not meet the requirement for determining an applicant’s eligibility."

TDIU is a way for the Department of Veterans Affairs (VA) to compensate totally and permanently disabled veterans at the 100 percent rate who are actually unable to work solely because of their service-connected disability, although their rating according to VA’s Schedule for Rating Disabilities (Rating Schedule, or "schedular") does not reach 100 percent but is nonetheless uniquely totally disabling. Nationally, about eight percent of disabled veterans have injuries or illnesses that left them even more disabled than provided for in VA charts. Remember: all VA ratings reflect the degree of impact an injury or illness have on the ability to work. Both 100% schedular and TDIU vets are rated precisely on that basis.

TDIU is based on a VA evaluation of the individual veteran’s capacity to engage in any substantially gainful occupation, defined as the inability to earn more than the federal poverty level. TDIU is rather than the schedular evaluation, based on the average impairment of earnings concept. TDIU takes occupation, experience and education issues as well as medical factors into account. Congress frequently reviews TDIU, and agrees that it is there "because each person is unique." VA agrees, telling Congress "Individual unemployability is necessary to overcome the inadequacies of the rating schedule" to rate a 100% totally and permanently disabled veteran.

For Colorado to exclude TDIU vets from the property tax exemption is to penalize them for the manner in which they became totally and permanently disabled in the line of duty, just as did 100% schedular vets.

TDIU 100% disability ratings are assigned when the service-connected medical disability is even worse than VA disability tables recognize. TDIU is assigned when that disability or combination of service-connected disabilities are evaluated and the VA concludes the veteran is exactly what the initials mean – totally and permanently disabled, never expected to be able to work again and even certified as such each year after being rated TDIU. These veterans would work if they could. Most are working-age and two-thirds have dependents to care for.

100% schedular veterans have a similar arrangement because their disabilities may also surpass rating tables. For them, VA can offer "Special Monthly Compensation" and pay the vet beyond the regular 100% disability table. This addresses situations where vets may be unable to care for themselves, are homebound, etc.

TDIU does not refer to a veteran who is simply unemployed. Rather, a TDIU rating refers to military injuries or illnesses are even worse than typical (say, unsatisfactory hip replacements that are typically rated 60-90% but that are for a particular veteran in fact end up completely, totally, forever 100% disabling.) And not only factually disabling, but agencies such as Social Security or state rehabilitation services determine are so severe as to actually prevent employment.

This means that beyond military-related physical injuries that prevent them from participating in many of life's activities, they could have trouble with mental health issues such as suicidal tendencies, problems with speech, near continuous panic or depression, chronic confusion, impaired impulse control, and difficulty in adapting to stressful environments.

Perhaps Colorado's legislators added the issue of unemployability to reduce the fiscal impact on the state, or as their barrier to the property tax exemption because of a stigma tied to the word "unemployed." Because they can't work, TDIU vets aren't even eligible for unemployment insurance – while VA 100% schedular vets can get unemployment compensation when eligible!

Such a negative attitude is misplaced as regards TDIU and it must be corrected. If Federal unemployment statistics only include in the definition of "unemployed'' those who are looking for, but can't (or won't) find work, Colorado legislators might have asked why shouldn't VA apply that same standard for TDIU benefit? Here are the facts.

The Department of Labor classifies persons as unemployed if they do not have a job, have actively looked for work in the prior 4 weeks, and are currently available for work. Persons counted as "unemployed'' aren't working for a variety of reason, many under their own control. TDIU disabled veterans, on the other hand, are entitled to a total disability rating because they are in actual fact unemployable, i.e., found upon careful exam by VA, Social Security or state rehab agencies to be unable to engage in gainful employment precisely because and only because– of VA-rated service-connected disabilities; disabilities that render them 100% disabled, have rendered them unable to ever work. The word unemployed does not apply. At all. In fact, 100% schedular vets can work and can also be unemployed.

VA recognized the logic of "one size does not fit all" for its volumes of standard disability ratings. This was back in the 1930's when medical experts, legislators and VA administrators established the first TDIU-type ratings. For example, not all hip replacements leave a veteran between 40 and 90% disabling as VA tables describe: Rather, some exceptions occur taking the disability up to a totality, regardless of "typical" ratings. VA and others in the veteran community realize that TDIU veterans are typically worse off financially than 100% schedular vets, because TDIU veterans cannot work; VA and Social Security monitor them, watching for any earned income.

By contrast, 100% schedular vets are encouraged to work, for better financial, mental and medical health. A vet in a wheelchair might pursue rehabilitation education and find employment, without abusing disability benefits from VA. A TDIU veteran, on the other hand, cannot work and if somehow they were to do so in something beyond sheltered workshop-type earnings would lose their VA benefits. Often TDIU veterans are referred to state rehabilitation agencies or to certified rehabilitation counselors (CRC) for verification of their physical inability to work.

I have a personal perspective of TDIU and the Colorado Disabled Veteran Property Tax Exemption. For seventeen years I was VA 100% TDIU and denied the exemption for the years I owned a home in Colorado. I was homebound, 100% disability retired by the Air Force and unable to work, cared for by others, totally disabled, treated for cancers, numerous operations, paralyzed in a wheelchair, and also VA rated "catastrophically disabled." And I was terminally ill.

I was denied our property tax exemption only because I was "individually unemployable" and specifically ruled out of Colorado's eligibility. In 2015, however, VA finally acted on decade-old disability claims and appeals, and I was suddenly 430% VA service connected combat-related disabled (actual number, but VA "math" tops out at 100% regardless of the total of all disabilities.) My VA compensation was retroactive as was the effective date of my 100% disability, but Colorado blocks any retroactive tax exemptions. The VA corrected its error retroactively but Colorado cannot. I guess I'm still terminally ill but not much has progressed in the wrong direction lately – no complaints here!

CONCLUSION: VA has two categories of veterans who, in the line of duty, suffered injuries or illnesses leaving them 100% permanently and totally disabled for life.

• The first group includes vets whose disabilities are, or add up to 100% per the standard charts uses for the typical severity of those disabilities. Colorado respects those veterans and offers a partial property tax exemption.

• The second group, Total Disability for Individual Unemployability (TDIU) includes also 100% disabled vets, servicemembers who have a very severe 60% disability or severe disabilities totaling 70%, but the particular severity of their illnesses or disabilities – their line of duty injuries – goes beyond the VA standard charts to total disability. They are not unemployed; they are unable to be employed! VA rates them as 100% permanently and totally disabled veterans. Colorado might respect these 100% disabled veterans who suffered severe illnesses or injuries in the line of duty, but Colorado saves money by illogically and unkindly excluding them from the partial property tax exemption we voters thought we were approving with Referendum E in 2006.

So that leads up to our solution. Let's update the statute defining "qualified veteran" to specifically include the TDIU veteran! Here's a proposed draft of such a bill.

DRAFT BILL– UVC GOALS & OBJECTIVES: ESTABLISH TDIU VETERANS' BENEFIT

First Regular Session

Seventy-fourth General Assembly

STATE OF COLORADO

INTRODUCED

LLS xxx SENATE BILL 22 -xxxx

SENATE SPONSORSHIP

HOUSE SPONSORSHIP

_____________________________________

Senate Committees:

House Committees:

___________________________________ A BILL FOR AN ACT

CONCERNING PROPERTY TAX EXEMPTION FOR QUALIFYING DISABLED VETERANS FOR ONE-HUNDRED PERCENT DISABLED VETERANS TO INCLUDE VETERANS WITH LINE-OF-DUTY DISABILITIES GIVEN A RATING BY THE US DEPARTMENT OF VETERANS AFFAIRS FOR PERMANENT, TOTAL DISABILITY FOR COMPENSATION BASED ON UNEMPLOYABILITY OF THE INDIVIDUAL. ____________________________________ Bill Summary

(Note: This summary applies to this bill as introduced and does not reflect any amendments that may be subsequently adopted. If this bill passes third reading in the house of introduction, a bill summary that applies to the reengrossed version of this bill will be available at http://leg.colorado.gov.)

CONCERNING THE INCLUSION OF ONE-HUNDRED PERCENT DISABLED VETERANS WITH LINE-OF-DUTY DISABILITIES THAT THE US DEPARTMENT OF VETERANS AFFAIRS HAS AWARDED A TOTAL AND PERMANENT DISABILITY RATING IN THE DEFINITION OF “QUALIFYING DISABLED VETERAN" FOR A PROPERTY TAX EXEMPTION FOR QUALIFYING SENIORS AND DISABLED VETERANS

________________________________

Be it enacted by the General Assembly of the State of Colorado:

SECTION 1. In Colorado Revised Statutes, 39-3-201, amend (1)(a) as follows:

39-3-201. Legislative declaration. (1) The general assembly hereby finds and declares that:

(a) Section 3.5 of article X of the state constitution, which was approved by the registered electors of the state at the 2000 general election and amended by the registered electors of the state at the 2006 general election, provides property tax exemptions for qualifying seniors and qualifying disabled veterans. TO MORE CLOSELY ALIGN WITH THE DESCRIPTION OF "DISABLED VETERAN" IN REFERENDUM E AS APPROVED BY THE ELECTORS IN 2006, "DISABLED VETERANS," IS DEFINED IN ACCORDANCE WITH THE REQUIREMENTS OF SECTION 2-2-208, IN SECTION 39-3-202 (3.5) AS "QUALIFYING VETERANS" FOR PURPOSES OF THIS PART 2;

SECTION 2. In Colorado Revised Statutes, 39-3-202, amend (3.5) as follows:

39-3-202. Definitions. As used in this part, unless the context otherwise requires: (1.5) "Exemption" means the property tax exemptions for qualifying seniors and qualifying disabled veterans allowed by section 39-3-203.

(3.5) "Qualifying disabled veteran " means an individual who has served on active duty in the United States armed forces, including a member of the Colorado National Guard who has been ordered into the active military service of the United States, has been separated therefrom under honorable conditions, and has established AND MAINTAINED A service-connected disability that has been rated by the federal department of veterans affairs as a one hundred percent permanent disability OR HAS BEEN GIVEN BY THE US DEPARTMENT OF VETERANS AFFAIRS A PERMANENT, TOTAL DISABILITY RATING FOR COMPENSATION BASED ON UNEMPLOYABILITY OF THE INDIVIDUAL through disability OR retirement benefits pursuant to a law or regulation administered by the department, the United States department of homeland security, or the department of the Army, Navy or Air Force.

SECTION 3. In Colorado Revised Statutes, 39-3-202, amend (3.5) as follows:

39-3-202. Definitions. As used in this part, unless the context otherwise requires:

(3.5) "Qualifying disabled veteran " means an individual who has served on active duty in the United States armed forces, including a member of the Colorado National Guard who has been ordered into the active military service of the United States, has been separated therefrom under honorable conditions, and has established AND MAINTAINED a service-connected disability that has been rated by the federal department of veterans affairs as a one hundred percent permanent disability OR HAS BEEN GIVEN BY THE US DEPARTMENT OF VETERANS AFFAIRS A PERMANENT, TOTAL DISABILITY RATING FOR COMPENSATION BASED ON UNEMPLOYABILITY OF THE INDIVIDUAL through disability OR retirement benefits pursuant to a law or regulation administered by the department, the United States department of homeland security, or the department of the Army, Navy or Air Force.