(From the 2006 Blue Cook - what we were asked to approve. See my 2017 here, and my 2021 analysis below*)

Legislative Council of the Colorado General Assembly

REFERENDUM E:

Summary and Analysis (Research Pub. No. 554)

How does the program work?

Homeowners pay property taxes based on the value of their home and the tax rate set by the local governments where they live. Referendum E reduces the taxable value of a qualified veteran's home by one-half of the first $200,000 of the home's value, thereby lowering property taxes owed on the home. The state legislature can adjust the $200,000 amount to either increase or decrease the benefit from Referendum E in future years.

Homeowners pay property taxes based on the value of their home and the tax rate set by the local governments where they live. Referendum E reduces the taxable value of a qualified veteran's home by one-half of the first $200,000 of the home's value, thereby lowering property taxes owed on the home. The state legislature can adjust the $200,000 amount to either increase or decrease the benefit from Referendum E in future years.

Currently, the state offers the same property tax reduction to homeowners age 65 and over who have lived in their homes for at least ten years. A qualifying veteran who is also eligible for a reduction in property taxes as a senior cannot claim both reductions. The dollar amount of the tax reduction will vary among homeowners depending upon the local property tax rate, the home's value, and the amount of the exemption.

Who qualifies for the tax reduction? Homeowners who have served on active duty in the U.S. Armed Forces and are rated 100-percent permanently disabled by the federal government due to a service-connected disability qualify for the tax reduction in Referendum E. Colorado National Guard members injured while serving in the U.S. Armed Forces also qualify. Veterans are rated 100-percent permanently disabled when a mental or physical injury makes it impossible for the average person to hold a job and the disability is lifelong. (1)

Nationally, less than one percent of veterans have a 100-percent permanent disability rating. About 2,200 veterans are expected to qualify for the property tax reduction in Colorado.

What are the fiscal implications? Referendum E affects property taxes paid beginning in 2008. The average property tax savings for those who qualify will be about $466. The total reduction in property taxes is estimated to be about $1 million in the first year.(2)

The state is required to reimburse local governments for the reduction in property tax revenue resulting from Referendum E.

Arguments For:

1) Colorado needs to do more to help veterans who have sacrificed their health for our nation and state.(3) Many states offer a property tax reduction for disabled veteran homeowners, and six states do not require these veterans to pay any property taxes. (4)

Referendum E provides one way, at a modest cost, for Colorado to thank 100-percent permanently disabled veterans for their service.

2) The money that Referendum E saves qualifying veterans can improve their quality of life. Despite existing government benefits, veterans still have unmet financial needs that are tied to their disability.

Unlike most other citizens, 100-percent permanently disabled veterans have very limited opportunities to improve their quality of life through employment and other means. (5)

Referendum E is an opportunity for the state to at least partially offset this economic disadvantage.

Arguments Against:

1) Referendum E is a special interest tax break that benefits less than one-twentieth of one percent of all Colorado residents. When one group benefits financially from a tax reduction, other taxpayers must pay. If the state can afford to reduce taxes for certain taxpayer groups, it should reduce taxes for all taxpayers. Referendum E further singles out a portion of the taxpayers it proposes to help by reducing taxes for 100-percent disabled veterans who are financially able to own homes. Disabled veterans who do not own a home do not benefit from this proposal. (6)

2) Because veterans were in the service of the federal government, the responsibility to meet the financial needs of veterans rests with the federal government. By creating a new state program for a small group of veterans, Referendum E interferes with the balance of benefits set by the federal government. In addition, the recent focus on international conflicts may lead voters to believe the state is providing a benefit to only those veterans who were injured in a combat zone when in fact the injury may have resulted while on call or during a time when the United States was not at war.

Estimate of Fiscal Impact:

Referendum E increases state expenditures because it requires the state to reimburse local governments for reduced property tax collections. The state estimates that roughly 2,200 disabled veterans will qualify for the exemption and the average property tax reduction per veteran will be $466. Thus, the impact to the state will be slightly more than $1 million, beginning with the 2008 budget year.(7)

------------here's my assessment after 3 years study-----------

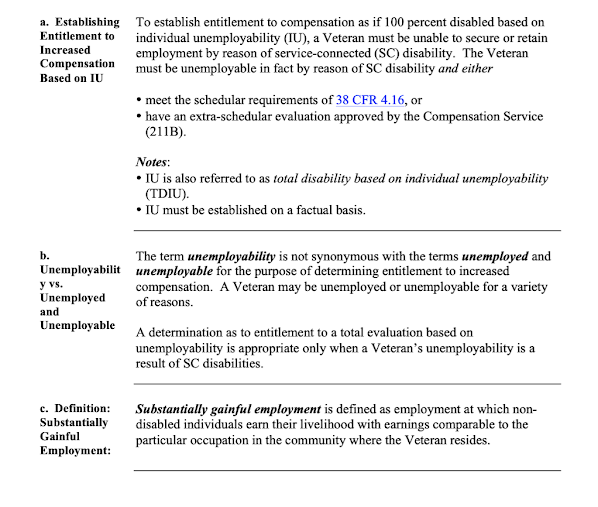

1. Notice no mention of unemployability, the disqualifier added by Colorado's legislators, DOLA or CDMVA, isn't in the Blue Book, but "disabled veteran" is clearly described. Voters are told the benefit we approve is for "Homeowners who have served on active duty in the U.S. Armed Forces and are rated 100-percent permanently disabled by the federal government due to a service-connected disability" and "100-percent permanently disabled veterans have very limited opportunities to improve their quality of life through employment and other means. The more exact term for this is "total disability for individual unemployability." or TDIU. It is total, and it is permanent. TDIU and 100% schedular disability ratings are about 8% of VA Disabled veterans (TDIU and 100% schedular) are about 8% of VA disability ratings. Nationwide, there are about 800,000 such ratings.

Unemployability, as defined by VA, from their web site:

"VA Individual Unemployability if you can't work

If you can’t work because of a disability related to your service in the military (a service-connected disability), you may qualify for what’s called “Individual Unemployability.” This means you may be able to get disability compensation or benefits at the same level as a Veteran who has a 100% disability rating.

Am I eligible for disability benefits from VA? You may be eligible for disability benefits if you meet both of the requirements listed below.

Both of these must be true:

You have at least 1 service-connected disability rated at 60% or more disabling, or 2 or more service-connected disabilities—with at least 1 rated at 40% or more disabling and a combined rating of 70% or more—and

You can’t hold down a steady job that supports you financially (known as substantially gainful employment) because of your service-connected disability. Odd jobs (marginal employment) don’t count."

TDIU is total, and it is permanent. TDIU veterans are actually not able or even permitted to work because VA has examined them and determined that their combination of service-connected disabilities make it impossible to do so. VA even monitors IRS and Social Security records to double-check veterans awarded this disability rating, although vets are permitted odd jobs. Vets with the "regular" VA rating of 100% disability are permitted to work and encouraged to try doing so if possible for good mental and physical health and for economic security.

2. The total veterans and qualified survivors is currently 5858, compared to 245,000 receiving the senior exemption, with an annual budget impact of $3,524,000 vs. $136,000,000 for seniors.

3. Colorado ranks just a modest 25th among the states in veterans' benefits. Many studies have proved the fact that the more veteran-friendly a state is, the more likely to benefit from veterans living there. The money and the needs of Colorado's military retirees, and disabled vets plus survivors created over 26,000 good Colorado jobs in 2020. As for the disabled veteran survivor property tax exemption, nobody expects a veteran's survivor to relocate here to save $645. Those who do from whatever state, are to be honored and eligible for the exemption we seek. Disabled veterans bring into Colorado VA checks for almost $2,000,000,000 to spend on food, clothing, shelter, medical care entertainment, travel – the cost to Colorado in its meager state benefits is a pittance against this. Totally disabled veterans' dependence on state public assistance is insignificant.

4. Currently nineteen states (up from six in 2006) waive all property taxes for disabled veterans and survivors. Most more states offering an exemption larger exemption offer more than Colorado. Only a few offer no exemption.

5. A TDIU veteran receives at most $37,570 per year, still a low range where many agencies assist families. This will be the vet's income throughout his/her life with no pay raises, no promotions, nothing beyond the VA monthly check. When most non-disabled veterans and civilians are approaching retirement age, having acquired wealth, home, car, etc., the average income is over $57,000 per year, leaving disabled veterans far, far behind. The younger the veteran when disabled, the further behind with age. Bankruptcies are common.

6. Home ownership is usually out of reach. However, any savings helps them afford to qualify for and continue to afford their own homes.

7. A TDIU veteran receives at most $37,570 per year, still a low range where many agencies assist families. This will be the vet's income throughout his/her life with no pay raises, no promotions, nothing beyond the VA monthly check. When most non-disabled veterans and civilians are approaching retirement age, having acquired wealth, home, car, etc., the average income is over $57,000 per year, leaving disabled veterans far, far behind. The younger the veteran when disabled, the further behind with age. Bankruptcies are common.