Five years ago

I wrote about the curious sleight of hand employed to sell the voters on a worthy Colorado constitutional amendment but then the enabling legislation delivered a greatly watered-down statute.

I backed off the subject after the United Veterans Committee (now United Veterans Coalition) made clear its nonsupport at that time. Understandably, it was best to avoid conflict and not mess up the carefully-crafted UVC legislative agenda. Happily, I understand that UVC has a related bill to increase the exemption as one of the 2021 objectives. Unhappily, I feel its cost of over $19M leaves no chance of success and UVC and the bill's sponsor might instead have pushed for Gold Star Wives and/or TDIU disabled veterans.

I refer here to Referendum E from back in 2006. Our legislature generously proposed a constitutional amendment (Article X Section 3.5) to provide a small partial property tax exemption to totally disabled veterans. Note the wording: "totally disabled veterans." Let's follow that bouncing ball of how definitions of "totally disabled veterans" kept a-changing – and to finally covered as few vets as possible:

Here is the full text of Referendum E to amend the state constitution:

"AN AMENDMENT TO SECTION 3.5 OF ARTICLE X OF THE CONSTITUTION OF THE STATE OF COLORADO, CONCERNING THE EXTENSION OF THE EXISTING PROPERTY TAX EXEMPTION FOR QUALIFYING SENIORS TO ANY UNITED STATES MILITARY VETERAN WHO IS ONE HUNDRED PERCENT PERMANENTLY DISABLED DUE TO A SERVICE-CONNECTED DISABILITY.”

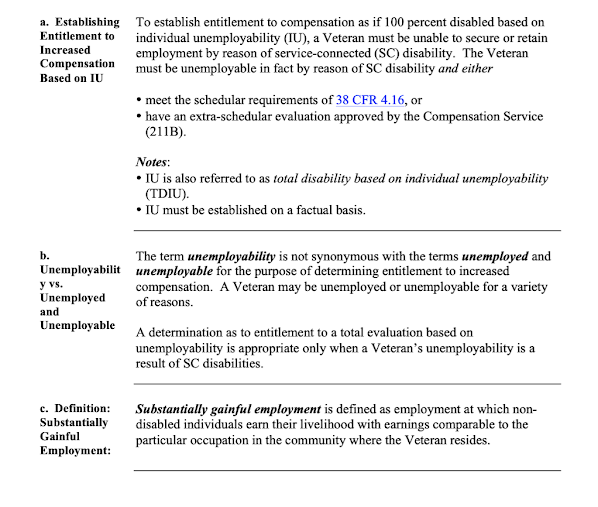

This is important: Note the "one hundred percent permanently disabled" and the separate phrase, "due to a service-connected disability." Here in Colorado those words are now interpreted to be one kind of totally disabled veteran but could be read to refer to two kinds. That's right. VA has two different types of totally and permanently disabled veterans. "TDIU" for total disability for individual unemployability" and 100% service connected disabled for vets with a disability, or group of disabilities when added together, equalling 100%.

Here is how the Legislative Council told us via the Blue Book what we were voting for:

"Veterans are rated 100-percent permanently disabled when a mental or physical injury makes it impossible for the average person to hold a job and the disability is lifelong."

An overwhelming 85% of Colorado voters approved this worthy benefit for those who served our state and nation. But then the lawmakers themselves got involved and took a fire hose to the benefit, watering it down quite a bit.

When Denver finally enacted legislation for the mechanics of Article X section 3.5 to work, Referendum E ended up much less broad than what we approved. The number of qualified recipients of the benefit was cut by more than half to protect budget resources for other projects.

Here is the actual text that finally delivered Referendum E to us as law:

"(3.5) “Qualifying disabled veteran” means an individual who has served on active duty in the United States armed forces, including a member of the Colorado National Guard who has been ordered into the active military service of the United States, has been separated therefrom under honorable conditions, and has established a service-connected disability that has been rated by the federal department of veterans affairs as a one hundred percent permanent disability through disability retirement benefits pursuant to a law or regulation administered by the department."

And next, here is the Colorado Department of Military and Veterans Affairs form for applicants, where there are two portions describing "totally disabled veterans."

"A “qualifying disabled veteran” is a person who meets each of the following requirements

- § 39-3-202(3.5), C.R.S . A “qualifying disabled veteran” is a person who meets each of the following requirements - § 39-3-202(3.5), C.R.S.• The veteran sustained a service-connected disability while serving on active duty in the Armed Forces of the United States. This includes members of the National Guard and Reserves who sustained their injury during a period in which they were called to active duty. • The veteran was honorably discharged.• The federal Department of Veterans Affairs has rated the veteran’s service-connected disability as a one hundred percent permanent disability through disability retirement benefits pursuant to a law or regulation administered by the department"

– and from the back page –

"2. DISABLED VETERAN STATUS: To qualify, both

questions must be true and you must attach a copy of your

VA award letter verifying that you have been given a

permanent disability rating by the VA."

CDMVA web site:

"The Disabled Veteran Property Tax Exemption is available to applicants who sustained a service-connected disability rated by the Federal Department of Veterans Affairs as a 100 percent permanent disability through disability retirement benefits pursuant to a law or regulation administered by the Department, the United States Department of Homeland Security, or the Department of the Army, Navy or Air Force. VA unemployability awards do not meet the requirement for determining an applicant’s eligibility."

So, after all this reading, do you see where the disabled veteran property tax exemption got watered down by more than half? It was through the disqualification of veterans rated totally and permanently disabled by VA for "unemployability." Tossed into the program are the words, "VA unemployability awards do not meet the requirement for determining an applicant’s eligibility." Note that these TDIU people aren't veterans who are out of work, but instead vets who've been evaluated as being physically unable to ever work. And are monitored to make sure that remains the case.

Side note: the constitution included as eligible veterans those who were medically retired by their service as 100% disabled. The fourteen words describing these vets were left out of the law until 2016, when HB16-1444 brought the tax legislation into accord with the constitution.

(Here is an analysis I prepared in 2016 when I last worked on disabled veteran unemployability tax exemption issues.)

VA "unemployability" is its 100% disability rating for vets with at least one 60% service-connected issue and whose overall disabilities are so severe, so far beyond the scope for which VA assigned the 60%, that any meaningful employment is impossible. VA has other rating of "catastrophically disabled" but even when a vet is rated both unemployable and catastrophically disabled, that doesn't meet CDMVA's redefinition of Referendum E also is awarded to vets with at least a 60% service-connected disability:

"Veterans are considered to be Catastrophically Disabled when they have a severely disabling injury, disorder or disease that permanently compromises their ability to carry out the activities of daily living. The disability must be of such a degree that the Veteran requires personal or mechanical assistance to leave home or bed, or require constant supervision to avoid physical harm to themselves or others."

Let's note that VA has two kinds of unemployability awards. The first is temporary or "IU," meant for periods of uncertainty about recovery or rehabilitation after surgery or illness, and the second is permanent (TDIU) for exactly that – permanent disability for life. TDIU veterans not only are medically determined to be unable to work, they are also carefully evaluated for that situation by the Veterans Benefit Administration before given the rating. Finally, they are carefully monitored by VA to check that they remain unable to work and both Social Security and IRS records are checked.

Because Colorado references the VA totally disabled rating everywhere, we should look at how VA itself describes a totally disabled veteran. Read carefully and compare to Colorado's absolute disqualification of TDIU vets from the Disabled Veteran Property Tax Exemption. Here is the VA Office of Inspector General's very appropriate definition:

"Veterans are considered to have total disability when they have a 100 percent disability rating due to service-connected disabilities or if their service-connected disabilities make them unemployable. For the total disability to be permanent, the law requires the disability to be “based upon an impairment reasonably certain to continue throughout life."

"The Veterans Benefits Administration Inadequately Supported Permanent and Total Disability Decisions",

VA OIG 19-00227-226, Page ii, September 10, 2020

Clearly, veterans with total disability, including TDIU, is what voters thought they were approving by votes for Referendum E back in 2006. So where did the Colorado prohibition of unemployability for the benefit come from?

I asked CDMVA and they said ask DOLA. I asked DOLA and in 2014 was told "some legislators" wanted that limitation. Legislators. Not the voters. Legislators introduced (snuck in!) their own idea of

disqualification into what voters more broadly approved as our constitutional amendment.

My view: Veterans with a 100% disability rating, including TDIU, were provided the small tax exemption via Referendum E when we voted approval. TDIU eligibility should be corrected by legislative action. I do not favor broadening the Disabled Veteran Property Tax Exemption below the 100% disability level as the impact would be far too burdensome on taxpayers.

Further, veterans often have disabilities common among folks their own age group, such as COPD, diabetes, hypertension and hearing loss. It would be unfair to a taxpayer with COPD to pay full property taxes while the veteran neighbor with a 50% COPD disability rating doesn't. The obvious need for tax relief is for survivors and the totally disabled veteran! Full stop.

Conclusion: A few legislators hijacked Referendum E and Article X Section 3.5 of the constitution, doing decades of harm to a large number of otherwise qualified Colorado totally disabled veterans and their survivors.

Time to set this right! What say you – Is 2022 too soon?