On Wednesday the United Veterans of Colorado met with legislators who sponsored last years' constitutional amendment adding Gold Star Spouses to the property tax exemption. We're grateful for their outstanding leadership, especially from Representative Cathy Kipp!

Colorado recognizes sacrifices of our totally disabled veterans, awarding a partial property tax exemption to 100 percent totally and permanently disabled veterans. The U.S. Department of Veterans Affairs has two types of 100% disabled veterans – (1) vets with a 100% disability (2) vets with a total disability rated “Total Disability for Individual Unemployability” (TDIU.) VA benefits for the two types are identical, but Colorado’s TDIU veterans are unfairly denied the exemption

Friday, March 31, 2023

Monday, March 20, 2023

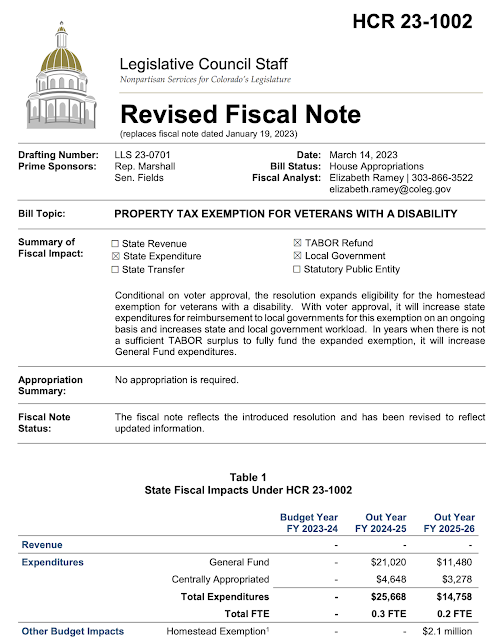

Colorado LSC initial cost estimate of $4.5 million for HB 23-1002 (TDIU) was inaccurate

(see revised budget impact from LSC correction below, based on this analysis)

a. VA “100% permanent and total schedular.” is a rating schedule which assigns a degree of total disability using a formula set by law ( 38 CFR 3.340, 38 CFR 3.341(a), and 38 CFR 4.16) for a full range of illnesses and/or injuries suffered by veterans while on active duty (or, for Reserve Components, while on active training status for when called to federal service.)b. The second is TDIU, a unique program created in 1933 to “fill the gap” in situations where a veteran’s line-of-duty illnesses or injuries are far more serious and exceed the schedular provisions, or when the combination of the veteran’s active duty illness or injuries are at least 70% but when considered with with other, lesser military injuries or illness have made the veteran totally disabled. This involves separate medical and administrative assessments: one evaluating military-related disabilities and a second to consider whether those military disabilities alone make employment impossible. This leaves the TDIU veteran at a fixed disability compensation at the 100% level, never able to continue productive employment.

Monday, February 20, 2023

A DISABLED VETERAN AND MILITARY RETIREE LOOKS AT HB23-1084 -Continuation of Military Retirement Benefit Deduction in Colorado

Tuesday, February 14, 2023

United Veterans Coalition of Colorado 2023 Legislative Goals

2023 Colorado legislative goals:

1. HB23-1084 Continuation Of Military Retirement Benefit Deduction

2. HB23-1052 Mod Prop Tax Exemption for Veterans with Disability (TDIU veteran's property tax exemption)

Thursday, November 10, 2022

VICTORY FOR GOLD STAR SPOUSES!

In a sweeping victory for the United Veterans of Colorado and Gold Star Spouses, voters approved amending the Colorado Constitution Article X Section 3.5 to extend the partial property tax exemption to Gold Star Spouses.

Several years of efforts, of resolutions passed by the American Legion, leadership of the UVC and patience of the Gold Star spouses themselves, all finally came to the best possible resolution – not only passed as required with 55% of the voters approving, but by an overwhelming 88%.

Saturday, June 4, 2022

Gold Star Spouse Property Tax Exemption WILL Be On November Ballet

This reflects terrific leadership by the legislative committee of the United Veterans Coalition, which made it their Number One legislative objective for 2022.

Congratulations to all who worked on this initiative and now, let's get the vote out for November!

In 2013 I identified three flaws in the state's property tax exemption law: failure to include disabled military retirees, failure to include Gold Star Wives, and failure to include veterans considered totally disabled by the VA with a rating called "total disability for individual unemployability."

So far, the first two are resolved and now we can set our sights on our worthy TDIU veterans, denied important state property tax benefits for far too long.

Wednesday, May 4, 2022

GOLD STAR SPOUSES PROPERTY TAX EXEMPTION ADVANCES TO SENATE FLOOR

Yesterday the Colorado Senate Appropriations Committee voted unanimously its approval of the Gold Star Spouses property tax exemption bill. Several senators on the committee spoke to the importance of this bill.

Once approved by the Senate and signed by the governor, the bill goes to voters in each senatorial district as a referendum on amending the state constitution to include Gold Star Spouses for the partial property tax exemption. Presently, survivors of totally disabled vets already receiving the exemption continue the exemption. The original language of the property tax exemption unfortunately didn't address the situation of servicemembers who die on active duty.

Tuesday, April 12, 2022

TDIU = actual VA TOTAL disability rating

A previous director of the Colorado Division of Military and Veterans Affairs wrote me six years ago to state that one reason Colorado denies TDIU veterans the state partial property tax exemption is that the state law requires a VA TOTAL DISABILITY RATING, and he explained that TDIU is somehow "only" compensation at the 100% rate and not an actual disability rating.

CDMVA hasn't made any visible effort to care for TDIU veterans the same as it cares for 100% schedular. A variety of reasons have been tossed out but as for TDIU being an actual disability,VA disagrees with CDMVA.

From Title 38, Chapter 4 (§ 4.15 Total disability ratings)

"It is the established policy of the Department of Veterans Affairs that all veterans who are unable to secure and follow a substantially gainful occupation by reason of service-connected disabilities shall be rated totally disabled"

Tuesday, April 5, 2022

New Diagnosis - Parkinson's Disease

They might have figured out some of the problems I've been having...I got diagnosed with Parkinson's last week. The symptoms are there but don't seem to be advancing too fast, so at age 75 I can hope to "age out" of the worst of it.

Another blessing brought to us by Agent Orange! Parkinson's, Parkinsonism and Parkinsons-like symptoms are now considered Agent Orange presumptive illnesses, along with bladder cancer and all the old favorites!

Monday, February 21, 2022

My College Roommate Wins 100% Disability Claim - after VA lost his papers for half a century!

Yesterday my college roommate Paul heard from VA that his supplemental claim for disability has been approved. He's now backdated 100% to December 2020! Great news, following the first claim being approved earlier for hearing loss at 40%. My strategy helping him was to tie certain current problems to his hearing loss as secondary issues. VA has agreed, following an appeal that reversed their initial denial.Now, he will get a better disability compensation, medical care for himself and family, some state benefits and, if and hen needed, nursing home or other such advanced care.

These are earned entitlements which he has been denied for the past half-century. Denied VA medical care, GI home loan, every state benefit withheld. There's no catch-up for what he's been refused.

Remember: this is a good outcome but it really is an immense VA failure! Paul first applied for VA disability benefits when he was released from active duty in 1969. He lived with his disability and forgot all about the VA claim which, decades later, was finally found in his Army dental records. The VA never found this critical document: It took his attorney Katrina Eagle a couple hours. Perhaps...VA didn't give a damn?A veteran has a reasonable beef with the VA when they take half a century to resolve a claim, meanwhile denying all federal and state benefits. Paul has a beef, but right now he's simply glad things have gotten straightened out.The VA tried. Dragged it out fifty years, and if only the process had taken a bit longer, until Paul had passed, VA could cancel his claim altogether because when the vet dies, so does the claim. Too bad, VA. At least you made it into your disgusting "Claim Ignored 50 Years Club."

Over half a century. But who's counting?