WHEREAS, on April 5, 2021 the Seventy-third General Assembly of the State of Colorado issued Senate Joint Resolution 21-010, resolving on behalf of the citizens “That we, the members of the Colorado General Assembly, honor the pride and the pain of the parents and partners and children and siblings of our fallen heroes who lost his or her life serving our country and protecting our freedom; and recognize the families of these proud patriots with an expression of profound gratitude and respect” and

Colorado recognizes sacrifices of our totally disabled veterans, awarding a partial property tax exemption to 100 percent totally and permanently disabled veterans. The U.S. Department of Veterans Affairs has two types of 100% disabled veterans – (1) vets with a 100% disability (2) vets with a total disability rated “Total Disability for Individual Unemployability” (TDIU.) VA benefits for the two types are identical, but Colorado’s TDIU veterans are unfairly denied the exemption

Monday, June 28, 2021

Text of American Legion resolution supporting Gold Star Wives property tax exemption

WHEREAS, on April 5, 2021 the Seventy-third General Assembly of the State of Colorado issued Senate Joint Resolution 21-010, resolving on behalf of the citizens “That we, the members of the Colorado General Assembly, honor the pride and the pain of the parents and partners and children and siblings of our fallen heroes who lost his or her life serving our country and protecting our freedom; and recognize the families of these proud patriots with an expression of profound gratitude and respect” and

Saturday, June 26, 2021

June 26: American Legion Votes Support of Gold Star Wives Property Tax Exemption

The resolution initiated with the Legion post in Fort Collins.

The Legion's resolution urges UVC to include the issue in its 2022 state legislative agenda. The coalition's agenda is yet be finalized. Obviously the legislature itself must agree to a solution during the next session.

Left unclear is whether a constitutional amendment or an act of the legislature will be the preferred approach.

The Legion's approved resolution joins that of the Military and Veterans Affairs Committee of the Colorado Bar Association, plus our own from the C-123 Veterans Association. It remains for the Gold Star Wives, not third parties, to actually initiate UVC consideration of this issue.

(click: resolution of American Legion Department of Colorado)

Thursday, June 24, 2021

Colorado Legislature Wraps Up, Gets Set for 2022

All hope for Gold Star Wives' property tax exemption rose suddenly during the last few days of the 2021 legislative session...and were shot down even faster! The House passed HB21-1002 unanimously but the Senate Veterans and Military Affairs Committee destroyed hopes for this legislation with just a few minutes conversation among the Democrats. Party line vote: Dems=NO, GOP-YES, but the measure failed with Dems in the majority.

| Oh, dear. I'm afraid we're back to the old drawing board. |

Saturday, June 19, 2021

United Veterans Committee Crafting State Legislative Agenda for 2022. TDIU Veterans Issue Proposed to the Committee

The decision will be based on input from all levels of UVC organizational members. This is an issue I've advocated about for six years. I ask everyone to get behind this agenda item, voicing your support directly to the state legislative affairs committee and the executive committee as all such potential agenda issues are being weighed this summer.

Inclusion of TDIU veterans affects about 2,000 Colorado vet homeowners and survivors, at a cost to Colorado at about $2.6M. Voters originally approved the Disabled Veteran Property Tax Exemption as Referendum E in 2006. The Blue Book described the benefit for "totally disabled veterans unable to work" due to line-of-duty injuries and illnesses. Somehow, "unemployability" was written into the enabling legislation and statue after the amendment was approved. That's not what the voters thought we were approving.

I hope the legislature to include these ignored 100% disabled veterans by exercising its authority to redefine "qualified veteran." A revised statute can include TDIU vets.

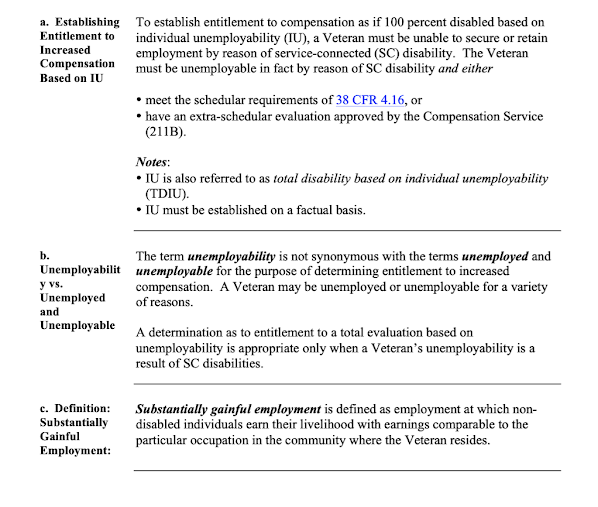

Colorado utilizes VA definitions for management of veterans benefits, so it is very telling to see VA's own rules from VAM21-1 on TDIU. Read carefully, and compare to the language of Referendum E, the enabling statute and the Disabled Veteran Property Tax Exemption form and instructions.

As for Gold Star Wives, the Legislative Support Staff calculated the cost to Colorado would be only $93,000, so it is very, very hard to understand why every Democrat voted against these 140 Gold Star Wives' much too small a benefit.United Veterans Coalition Considering Agenda Item: Property Tax Exemption for Gold Star Wives

The United Veterans Coalition state legislative affairs committee is considering addition of the Gold Star Wives Disabled Veteran Survivor Property Tax Exemption for inclusion in the 2022 legislative agenda.

The United Veterans Coalition state legislative affairs committee is considering addition of the Gold Star Wives Disabled Veteran Survivor Property Tax Exemption for inclusion in the 2022 legislative agenda.

The decision will be based on input from the Gold Star Wives and other primary organization members. I encourage everyone having an opinion on the issue to voice it through their primary group representatives.

The issue was unanimously approved by the Colorado House in the session just ended but killed by the Senate Military and Veterans Affairs Committee. The idea was to submit a referendum to the voters next term, amending the constitution's Article X Section 3.5 to include these active-duty troops' survivors. I believe the change could have been made via statute, a much easier path than changing the consitution.

The Legislative Support Staff calculated the cost to Colorado would be only $93,000, so it is very, very hard to understand why every Democrat voted against these 140 Gold Star Wives' small benefit.

Tuesday, June 15, 2021

COLORADO SENATE SNUBBED FAMILIES – KILLED GOLD STAR WIVES' PROPERTY TAX EXEMPTION

|

| June 7 2021: Colorado Senate killed Gold Star Wives bill for given survivors of totally disabled veterans (HCR21-1002 |

Monday, June 14, 2021

Colorado Voters Have a Long Memory - especially about how veterans and their survivors are treated

I believe Colorado's Democrat legislators have initiated the more important advances in veterans' benefits, but it would be wrong to conclude that either party is truly disinterested or uncaring. Democrats controlled the House and Senate in 2006 under a Republican governor and are together credited with getting Referendum E in front of the voters. There, the constitutional amendment found overwhelming support. This established the Disabled Veterans Property Tax Exemption in 2007 and reflected well on both parties.

Sunday, June 13, 2021

C-123 Veterans Association Joins Colorado's United Veterans Coalition

To better support state and federal veterans' issues, The C-123 Veterans Association has affiliated with Colorado's United Veterans Coalition (UVC.) UVC is the single most effective voice for over 350,000 veterans in Colorado. It brings together the VA and nearly every interested organization and political entity in the state.

RADM Dick Young USNR (Ret.) was elected president last week. UVC will celebrate is annual banquet on June 27 and tickets are still available.

How'd that Colorado Senate vote go for Gold Star Wives' property tax exemption?

June 7 2021: HOW DID COLORADO STATE SENATORS VOTE TO PERMIT GOLD STAR WIDOWS THE SAME PROPERTY TAX EXEMPTION COLORADO GIVES DISABLED VETS' WIDOWS? One Guess. | |||

| DEMOCRATS = 100% NO GOP = 100% YES Interesting. And very, very revealing. Every senator* who voted "YES" to honor our Gold Star Wives with SJR21-010 in May seemed to see things differently on June 7, and voted "NO" on HCR21-1002. Thumbs down on spending $93,000 to permit these 140 widows of active-duty troops same small partial property tax exemption Colorado now gives survivors of our 100% disabled veterans. Here are their empty words from SJR21-010 tossed to the wind, now shown to be useless and meaningless: "That we, the members of the Colorado General Assembly honor the pride and the pain of the parents and partners and children and siblings of our fallen heroes and recognize the families of these proud patriots with an expression of profound gratitude and respect." * voting no:

|