Colorado recognizes sacrifices of our totally disabled veterans, awarding a partial property tax exemption to 100 percent totally and permanently disabled veterans. The U.S. Department of Veterans Affairs has two types of 100% disabled veterans – (1) vets with a 100% disability (2) vets with a total disability rated “Total Disability for Individual Unemployability” (TDIU.) VA benefits for the two types are identical, but Colorado’s TDIU veterans are unfairly denied the exemption

Friday, May 28, 2021

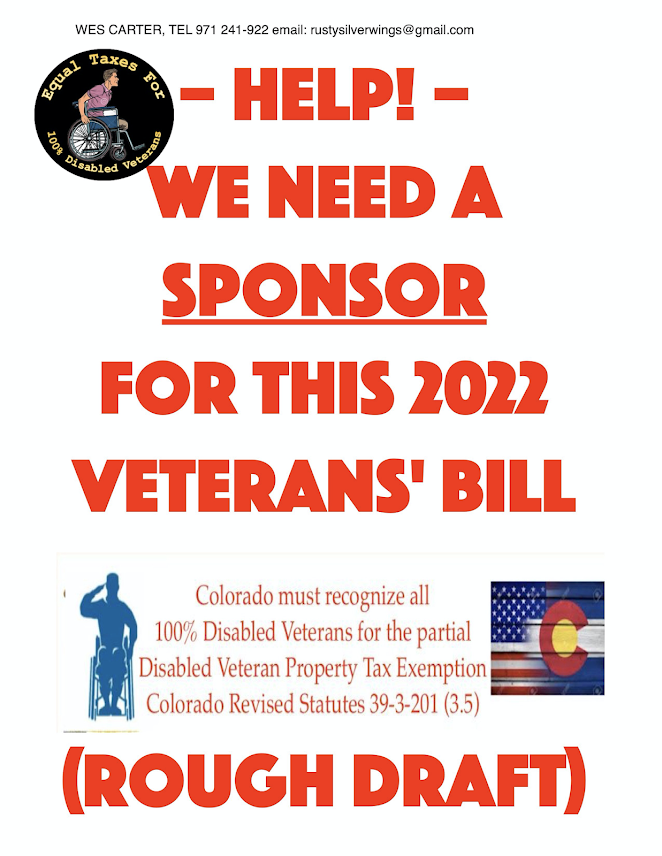

Colorado Legislature: Sponsor Needed for 100% Disabled Veteran Property Tax Exemption

Thursday, May 27, 2021

Colorado Legislature: Sponsor Needed for 100% Disabled Veteran Property Tax Exemption

Wednesday, May 19, 2021

REPRINT: Back in 2017 I complained that the state ignored HB16-1444 – Still little compliance with constitution!

by Wes Carter, National Chairperson, The C-123 Veterans Association

It’s damn hard to believe. Over this last decade state officials simply ignored property tax provisions spelled out in Colorado’s constitution to provide a small exemption to totally disabled troops retired by the military for line-of-duty injuries. It’s like the law simply went missing in action.

Back in 2006 voters amended our constitution, approving by a four-to-one margin to provide a small, partial property tax exemption. Only about $6000 value on average, the exemption is for two categories of injured servicemembers: Troops retired by the military as totally and permanently, and second, veterans rated 100% totally and permanently disabled by the Department of Veterans Affairs – "TDIU."

Referendum E carefully addressed both of the above categories because there are three differences between them:

1. Not all disabled military retirees also seek a VA disability rating – ratings must be applied for and, unlike military disability retirements, can take months or years to establish

2. Although based on similar laws, often military retirees face years of delays with claims and appeals to receive VA ratings, but military disability retirements are effective immediately upon leaving active duty

3. The military views a disability as medically unable, through line-of-duty illness or injury, to perform one's military specialty or be retrained in another; VA views disability as the percentage of loss of capacity to work in meaningful employment, somewhat similar to Social Security disability rules

(real example: Northern Colorado resident Vietnam-era veteran medically retired as 100% by the military in 1991 because of Gulf War injuries. Filed VA claims for numerous 100% disabling injuries and Agent Orange illnesses in 1992-1994 but not finally approved for 100% VA disability rating until 2015. Per our constitution's Article X Section 3.5, this veteran was eligible for Colorado's disabled veteran tax exemption in 2007. As of December 2017, still no state web site instructions or forms permit his application because only federal VA 100% disability ratings are mentioned, not his 100% military medical retirement.)

Problem: Through an oversight when the 2007 statute was drafted, the category of totally disabled military retirees was simply not mentioned…language about them is in the constitution, but was absent from the text of the law.

In 2015 concerned citizens discovered this missing language issue and asked the legislature to align the constitution with the statute. Both houses approved HB-1444 unanimously and it was signed into law in May 2016.

And then, generally ignored by state and local officials.

Rough Draft: Colorado Disabled Vet Property Tax Exemption for "Total Disability for Individual Unemployability" Veterans

(Universal Citation: CO Rev Stat § 39-3-201 (2018))

"Individual unemployability may be established when a veteran is unable to secure or retain employment by reason of a service-connected disability or disabilities. A veteran may be unemployed or unemployable for a variety of reasons. When VARO staff deem a veteran is unemployable due to service related disabilities, the veteran is entitled to Individual Unemployability (IU) benefits. In such cases, disability compensation payments are elevated to the 100 percent rate even if the medical condition(s) are evaluated as less than 100 percent disabling. In order to continue disability payments at the 100 percent rate based on TDIU, veterans must confirm annually that he/she continued to be unemployed for service-connected medical issues.

"To be considered for TDIU P&T status, the law requires veterans to have a “total disability permanent in nature.” Veterans are considered to have total disability when they have a 100 percent disability rating due to service-connected disabilities or if their service-connected disabilities make them unemployable. For the total disability to be permanent, the law requires the disability to be “based upon an impairment reasonably certain to continue throughout the life of the veteran."

• With our wars winding down, both types of VA 100% disability ratings will also decline. Using Census and VA data, we can expect new veterans with 100% disabilities to be less than 75% of what we've suffered annually since the First Gulf War.

• Not only will there be fewer exemption claimants because of the veterans' aging population and because of a smaller US military, but there will be also fewer additions to our number of totally disabled veterans than we've seen these last twenty years. This reflects moving from combat plus peacetime training to peacetime disabilities alone.

"AN AMENDMENT TO SECTION 3.5 OF ARTICLE X OF THE CONSTITUTION OF THE STATE OF COLORADO, CONCERNING THE EXTENSION OF THE EXISTING PROPERTY TAX EXEMPTION FOR QUALIFYING SENIORS TO ANY UNITED STATES MILITARY VETERAN WHO IS ONE HUNDRED PERCENT PERMANENTLY DISABLED DUE TO A SERVICE-CONNECTED DISABILITY.

Who qualifies for the tax reduction? Homeowners who have served on active duty in the U.S. Armed Forces and are rated 100-percent permanently disabled by the federal government due to a service-connected disability qualify for the tax reduction in Referendum E. Colorado National Guard members injured while serving in the U.S. Armed Forces also qualify. Veterans are rated 100-percent permanently disabled when a mental or physical injury makes it impossible for the average person to hold a job and the disability is lifelong.

"VA unemployability awards do not meet the requirement for determining an applicant’s eligibility."

Such a negative attitude is misplaced as regards TDIU and it must be corrected. If Federal unemployment statistics only include in the definition of "unemployed'' those who are looking for, but can't (or won't) find work, Colorado legislators might have asked why shouldn't VA apply that same standard for TDIU benefit? Here are the facts.

• The first group includes vets whose disabilities are, or add up to 100% per the standard charts uses for the typical severity of those disabilities. Colorado respects those veterans and offers a partial property tax exemption.

• The second group, Total Disability for Individual Unemployability (TDIU) includes also 100% disabled vets, servicemembers who have a very severe 60% disability or severe disabilities totaling 70%, but the particular severity of their illnesses or disabilities – their line of duty injuries – goes beyond the VA standard charts to total disability. They are not unemployed; they are unable to be employed! VA rates them as 100% permanently and totally disabled veterans. Colorado might respect these 100% disabled veterans who suffered severe illnesses or injuries in the line of duty, but Colorado saves money by illogically and unkindly excluding them from the partial property tax exemption we voters thought we were approving with Referendum E in 2006.

___________________________________ A BILL FOR AN ACT

CONCERNING PROPERTY TAX EXEMPTION FOR QUALIFYING DISABLED VETERANS FOR ONE-HUNDRED PERCENT DISABLED VETERANS TO INCLUDE VETERANS WITH LINE-OF-DUTY DISABILITIES GIVEN A RATING BY THE US DEPARTMENT OF VETERANS AFFAIRS FOR PERMANENT, TOTAL DISABILITY FOR COMPENSATION BASED ON UNEMPLOYABILITY OF THE INDIVIDUAL. ____________________________________ Bill Summary

(Note: This summary applies to this bill as introduced and does not reflect any amendments that may be subsequently adopted. If this bill passes third reading in the house of introduction, a bill summary that applies to the reengrossed version of this bill will be available at http://leg.colorado.gov.)

CONCERNING THE INCLUSION OF ONE-HUNDRED PERCENT DISABLED VETERANS WITH LINE-OF-DUTY DISABILITIES THAT THE US DEPARTMENT OF VETERANS AFFAIRS HAS AWARDED A TOTAL AND PERMANENT DISABILITY RATING IN THE DEFINITION OF “QUALIFYING DISABLED VETERAN" FOR A PROPERTY TAX EXEMPTION FOR QUALIFYING SENIORS AND DISABLED VETERANS

________________________________

Monday, May 17, 2021

These outsider efforts re: Gold Star Wives' Colorado property tax exemption are now suspended

At this point it seems best to cease our outsider efforts hoping for addition of the Gold Star Wives Colorado property tax exemption to the United Veterans Coalition 2022 state legislative agenda. The work was unhelpful and trod on other veterans' needs.

Sunday, May 16, 2021

SITREP 18 May 2021: Report to Colorado Gold Star Wives re: Property Tax Exemption

DRAFT: AMENDMENT TO COLORADO CONSTITUTION FOR GOLD STAR WIVES PROPERTY TAX EXEMPTION

approach will work. Thus, the necessity of drafting a bill and an amendment -let Denver decide!

Here's the amendment:

BALLET TITLE

Shall there be an amendment to the Colorado constitution Article X Section 3.5 concerning the disabled veteran’s survivor property tax exemption, and, in connection therewith, provide for qualification of the surviving spouse of a servicemember of the Armed Forces of the United States who is missing in action or whose death is in the line of duty, and provide for the qualification of the surviving spouse of a servicemember of the Colorado National Guard whose death is in the line of duty while activated for a state contingency?

Bill Summary

(Note: This summary applies to this bill as introduced and does not reflect any amendments that may be subsequently adopted. If this bill passes third reading in the house of introduction, a bill summary that applies to the reengrossed version of this bill will be available at http://leg.colorado.gov.)

Under current law, 50 percent of the first $200,000 of actual value of the owner-occupied primary residence of a qualifying senior or a qualifying disabled veteran or surviving spouse of a qualifying disabled veteran who is in receipt of the exemption at the time of death, is exempt from property taxation. This wording excludes a surviving spouse of a servicemember whose death is while on active duty in the Armed Forces of the United States and excludes a surviving spouse of a servicemember of the Colorado National Guard whose death is while activated for a state contingency. The amendment expands the definition of “veteran who is in receipt of the exemption at the time of death” to include a servicemember of the Armed Forces of the United States who is missing in action or whose death is in the line of duty and to include a servicemember of the Colorado National Guard whose death is while activated for a state contingency.

SUBMITTING TO THE REGISTERED ELECTORS OF THE STATE OF COLORADO AN AMENDMENT TO SECTION 3.5 OF ARTICLE X OF THE CONSTITUTION OF THE STATE OF COLORADO, CONCERNING EXTENSION OF THE EXISTING PROPERTY TAX EXEMPTION FOR A QUALIFYING SURVIVING SPOUSE TO INCLUDE THE SURVIVING SPOUSE OF A MEMBER OF UNITED STATES MILITARY UNITED STATES WHO IS MISSING IN ACTION OR WHOSE DEATH WAS IN THE LINE OF DUTY, AND TO A SURVIVING SPOUSE OF A MEMBER OF THE COLORADO NATIONAL GUARD WHOSE DEATH WAS WHILE ACTIVATED FOR STATE CONTINGENCY.

Text of measure

Be It Resolved by the Senate of the Sixty-fifth General Assembly of the State of Colorado, the House of Representatives concurring herein:

SECTION 1. At the next election at which SENATE CONCURRENT RESOLUTION 22-xxx1 question may be submitted, there shall be submitted to the registered electors of the state of Colorado, for their approval or rejection, the following amendment to the constitution of the state of Colorado, to wit: Section 3.5 (1) (b) of article X of the constitution of the state of Colorado is amended, and the said section 3.5 is further amended BY THE ADDITION OF THE FOLLOWING NEW TEXT, to read:

Be it enacted by the people of the State of Colorado:

Article X is amended to add as follows: Add to Section 3.5 (1.5)(b)

Homestead exemption for qualifying senior citizens and disabled veterans AND SURVIVING SPOUSES.

(1) For property tax years commencing on or after January 1, 2002, fifty percent of the first two hundred thousand dollars of actual value of residential real property, as defined by law, that, as of the assessment date, is owner-occupied and is used as the primary residence of the owner-occupier shall be exempt from property taxation if:

(a) The owner-occupier is sixty-five years of age or older as of the assessment date and has owned and occupied such residential real property as his or her primary residence for the ten years immediately preceding the assessment date; or

(b) The owner-occupier is the spouse or surviving spouse of an owner-occupier who previously qualified for a property tax exemption for the same residential real property under paragraph (a) of this subsection (1); OR QUALIFYING SURVIVING SPOUSE OF A UNITED STATES MILITARY MEMBER MISSING IN ACTION OR WHOSE DEATH WAS IN THE LINE OF DUTY, OR A COLORADO NATIONAL GUARD MEMBER WHOSE DEATH WAS WHILE ACTIVATED FOR A STATE CONTINGENCY.

(c) FOR PROPERTY TAX YEARS COMMENCING ON OR AFTER JANUARY 1, 2022, ONLY, the owner-occupier, as of the assessment date, is a disabled veteran. (1.3) an owner-occupier may claim only one exemption per property tax year even if the owner-occupier qualifies for an exemption under both paragraph (c) of subsection (1) of this section and either paragraph (a) or paragraph (b) of subsection (1) of this section.

(1.5) for purposes of this section, "disabled veteran" means (A) an individual who has served on active duty in the United States armed forces, including a member of the Colorado National Guard who has been ordered into the active military service of the United States, has been separated therefrom under honorable conditions, and has established a service-connected disability that has been rated by the federal Department of Veterans Affairs as one hundred percent permanent disability through disability retirement benefits or a pension pursuant to a law or regulation administered by the department, the Department of Homeland Security, or the department of the Army, Navy, or Air Force, OR (B) A UNITED STATES MILITARY MEMBER MISSING IN ACTION OR WHOSE DEATH WAS IN THE LINE OF DUTY, OR A COLORADO NATIONAL GUARD MEMBER WHOSE DEATH WAS WHILE ACTIVATED FOR A STATE CONTINGENCY.

SECTION 2. Each elector voting at said election and desirous of voting for or against said amendment shall cast a vote as provided by law either "Yes" or "No" on the proposition: "AN AMENDMENT TO SECTION 3.5 OF ARTICLE X OF THE CONSTITUTION OF THE STATE OF COLORADO, CONCERNING EXTENSION OF THE EXISTING PROPERTY TAX EXEMPTION FOR QUALIFYING SURVIVING SPOUSES OF ANY UNITED STATES MILITARY MEMBER MISSING IN ACTION OR WHOSE DEATH WAS IN THE LINE OF DUTY, OR OF A COLORADO NATIONAL GUARD MEMBER WHOSE DEATH WAS WHILE ACTIVATED FOR A STATE CONTINGENCY

SECTION 3. The votes cast for the adoption or rejection of said amendment shall be canvassed and the result determined in the manner provided by law for the canvassing of votes for representatives in Congress, and if a majority of the electors voting on the question shall have voted "Yes", the said amendment shall become a part of the state constitution.

For purposes of this section, the text of Section 3.5 shall be expanded, to wit “owner-occupier who previously qualified for a property tax exemption OR A SERVICEMEMBER OF THE ARMED FORCES OF THE UNITED STATES WHO IS MISSING IN ACTION OR WHOSE DEATH IS IN THE LINE OF DUTY AND TO INCLUDE A SERVICEMEMBER OF THE COLORADO NATIONAL GUARD WHOSE DEATH IS WHILE ACTIVATED FOR A STATE CONTINGENCY.

(1) For property tax years commencing on or after January 1, 2002, fifty percent of the first two hundred thousand dollars of actual value of residential real property, as defined by law, that, as of the assessment date, is owner-occupied and is used as the primary residence of the owner-occupier shall be exempt from property taxation if:

(a) The owner-occupier is sixty-five years of age or older as of the assessment date and has owned and occupied such residential real property as his or her primary residence for the ten years immediately preceding the assessment date;

(b) The owner-occupier is the spouse or surviving spouse of A SERVICEMEMBER OF THE ARMED FORCES OF THE UNITED STATES WHO IS MISSING IN ACTION OR WHOSE DEATH IS IN THE LINE OF DUTY AND TO INCLUDE A SERVICEMEMBER OF THE COLORADO NATIONAL GUARD WHOSE DEATH IS WHILE ACTIVATED FOR A STATE CONTINGENCY OR an owner-occupier who previously qualified for a property tax exemption for the same residential real property under paragraph (a) of this subsection (1); or

(c) For property tax years commencing on or after January 1, 2007, only, the owner-occupier, as of the assessment date, is a disabled veteran. (1.3) An owner-occupier may claim only one exemption per property tax year even if the owner-occupier qualifies for an exemption under both paragraph (c) of subsection (1) of this section owner-occupier who previously qualified for a property tax exemption FOR PURPOSES OF ARTICLE X SECTION 3.5 ONLY, “OWNER-OCCUPIER WHO PREVIOUSLY QUALIFIED FOR A PROPERTY TAX EXEMPTION” SHALL ALSO INCLUDE A SERVICEMEMBER OF THE ARMED FORCES OF THE UNITED STATES WHO IS MISSING IN ACTION OR WHOSE DEATH IS IN THE LINE OF DUTY AND ALSO INCLUDE A SERVICEMEMBER OF THE COLORADO NATIONAL GUARD WHOSE DEATH IS WHILE ACTIVATED FOR A STATE CONTINGENCY.

Self-executing, severability, conflicting provisions. ALL PROVISIONS OF THIS SECTION ARE SELF-EXECUTING EXCEPT AS SPECIFIED HEREIN, ARE SEVERABLE, AND, EXCEPT WHERE OTHERWISE INDICATED IN THE TEXT, ALL PROVISIONS OF THIS SECTION SHALL BECOME EFFECTIVE UPON OFFICIAL DECLARATION OF THE VOTE HEREON BY PROCLAMATION OF THE GOVERNOR, PURSUANT TO SECTION 1(4) OF ARTICLE V.

Saturday, May 15, 2021

Modified Gold Star Wives Property Tax Exemption Bill - Added MIA

While MIA would be an unlikely event, the language is to avoid situations like the Vietnam War where servicemembers were sometimes missing for years and their families left in limbo, denied essential benefits.

Here's the updated text: