The decision will be based on input from all levels of UVC organizational members. This is an issue I've advocated about for six years. I ask everyone to get behind this agenda item, voicing your support directly to the state legislative affairs committee and the executive committee as all such potential agenda issues are being weighed this summer.

Inclusion of TDIU veterans affects about 2,000 Colorado vet homeowners and survivors, at a cost to Colorado at about $2.6M. Voters originally approved the Disabled Veteran Property Tax Exemption as Referendum E in 2006. The Blue Book described the benefit for "totally disabled veterans unable to work" due to line-of-duty injuries and illnesses. Somehow, "unemployability" was written into the enabling legislation and statue after the amendment was approved. That's not what the voters thought we were approving.

I hope the legislature to include these ignored 100% disabled veterans by exercising its authority to redefine "qualified veteran." A revised statute can include TDIU vets.

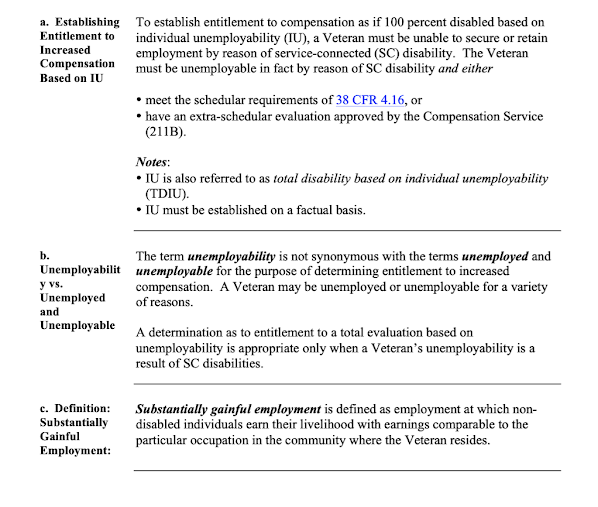

Colorado utilizes VA definitions for management of veterans benefits, so it is very telling to see VA's own rules from VAM21-1 on TDIU. Read carefully, and compare to the language of Referendum E, the enabling statute and the Disabled Veteran Property Tax Exemption form and instructions.

As for Gold Star Wives, the Legislative Support Staff calculated the cost to Colorado would be only $93,000, so it is very, very hard to understand why every Democrat voted against these 140 Gold Star Wives' much too small a benefit.